2021 Tax Brackets Au

2018 19 and 2019 20 2020 21 2021 22 2022 23 and 2023 24 from 2024 25 taxable income tax rate taxable income.

2021 tax brackets au. 5 092 plus 32 5 cents for each 1 over 45 000. The standard deduction for 2021 will be 25 100 an increase of 300 for married couples filing joint returns. The tax rates and brackets for the 2019 2020 year have not changed since the previous year 2018 2019.

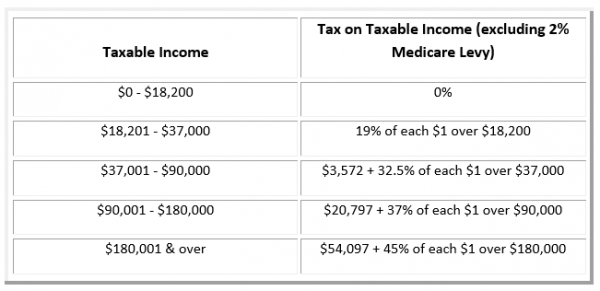

You can find our most popular tax rates and codes listed here or refine your search options below. 2021 tax year 1 march 2020 28 february 2021 see the changes from the previous year taxable income r rates of tax r 1 205 900 18 of taxable income 205 901 321 600 37 062 26 of taxable income above 205 900 321 601 445 100 67 144. This applies to all residents non residents and working holiday visa holders.

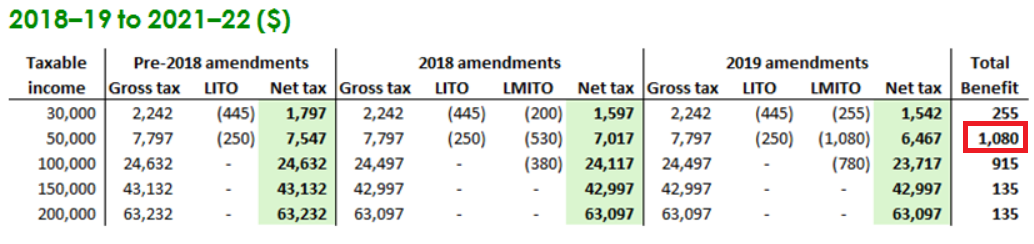

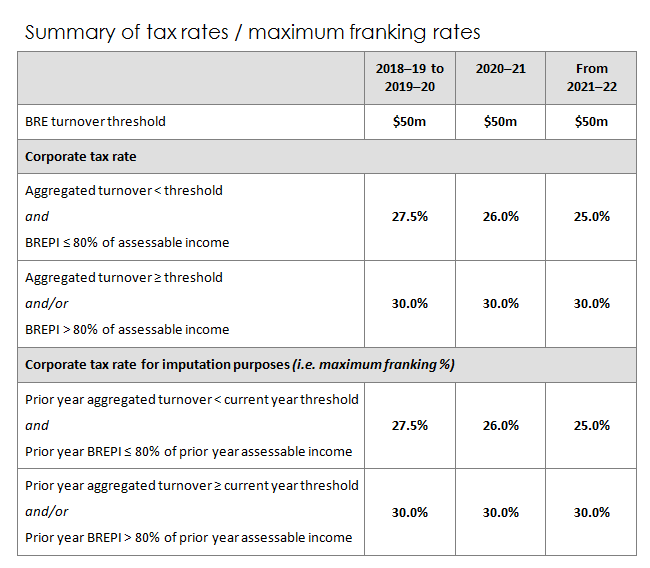

The 2018 budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 july 2018 through to 1 july 2024. The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. Learn the australian income tax rates for 2019 20 and 2020 21 as well as details on how income tax is calculated deductions offsets and levies.

19 cents for each 1 over 18 200. 12 550 an increase of 150 for single taxpayers individual returns and married individuals filing separately. 19c for each 1 over 18 200.

Irs 10 0 to 9 875 0 to 14 100. The tax brackets for each year are listed on the ato website. Make sure you click the apply filter or search button after entering your refinement options to find the specific tax rate and code you need.

And 18 800 an increase of 150 for heads of households. Tax rates 2020 2021 year residents the 2021 financial year starts on 1 july 2020 and ends on 30 june 2021. Australia has a progressive tax system which means that the.