2021 Tax Brackets Georgia

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household.

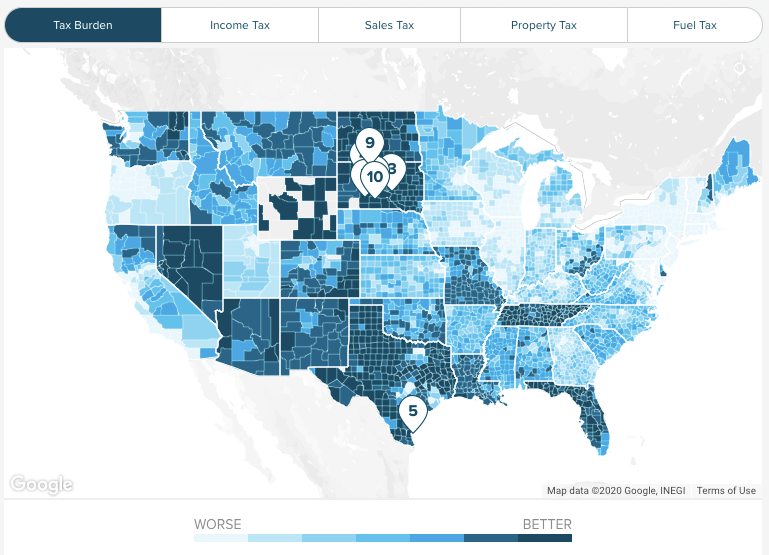

2021 tax brackets georgia. Sales tax rates general general rate chart effective january 1 2021 through march 31 2021 47 12 kb general rate chart effective october 1 2020 through december 31 2020 22 08 kb. 2021 federal tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Kpe personal exemption amounts as part of the tcja there are no personal exemption.

Taxable income between 40 525 to 86 375. Tuesday the georgia house of representatives passed hb 949 a bill to consolidate the state s six individual income tax brackets into one reduce the top rate from 5 75 percent to a new 5 375 percent flat rate eliminate the georgia itemized deduction for state. Deduct the amount of tax paid from the tax calculation to provide an illustration of your 2020 2021 tax.

Taxable income between 86 375 to 164 925. Georgia state income tax rate table for the 2020 2021 filing season has six income tax brackets with ga tax rates of 1 2 3 4 5 and 5 5 for single married filing jointly married filing separately and head of household statuses. Here s a first look at 2021 tax brackets and rates standard deductions and other cost of living adjustments.

Georgia has six marginal tax brackets ranging from 1 the lowest georgia tax bracket to 5 75 the highest georgia tax bracket. 2021 georgia tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household.

Detailed georgia state income tax rates and brackets are available on this page. 32 taxable income between 164 925 to 209 425. Each marginal rate only applies to earnings within the applicable marginal tax bracket.