2021 Tax Brackets Canada

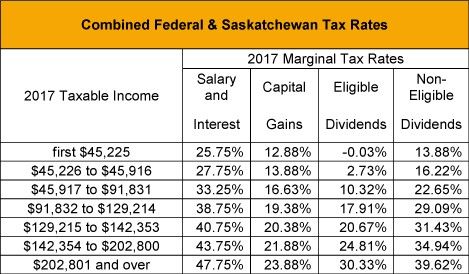

Your marginal tax rate is the total of both federal and provincial taxes on income.

2021 tax brackets canada. As economic pressure mounts the canada revenue agency cra and the federal government may introduce big changes in 2021. Tax rates 2020 2021 year residents the 2021 financial year starts on 1 july 2020 and ends on 30 june 2021. We ve got you covered.

Though actual tax brackets remained the same 10 12 22 24 32 and 35 income limits for each bracket were increased to account for inflation. The 2018 budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 july 2018 through to 1 july 2024. Tax rates for previous years 1985 to 2019 to find income tax rates from previous years see the income tax package for that year for 2018 and previous tax years you can find the federal tax rates on schedule 1 for 2019 and later tax years you can find the.

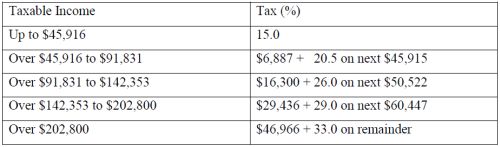

Remember settings performance cookies to measure the website s performance and improve your. So you know there are tax brackets in canada but what are they this year. The next 47 629 you earn is taxed at 20 5 percent while the following 52 408 is taxed at 26 percent.

These tax brackets add 9 763 94 and 13 626 08 respectively bringing your tax bill to 30 534 52 at this point 147 667 of your income has been taxed. The standard deduction for 2021 was also increased. Canada tax tables federal and province 2020 2021 tax tables this page contains the latest federal and province tax tables for canada.

The marginal tax rates above have been adjusted to reflect this change. Personal tax and rrsp tax savings calculators and tax rate cards. Tax rates marginal personal income tax rates for 2021 and 2020 2021 2020 tax brackets and tax rates canada and provinces territories choose your province or territory below to see the combined federal provincial territorial marginal tax.

Getty images this year has been a history making one for. Functional cookies to enhance your experience e g. The additional 0 21 is calculated as 15 x 13 808 12 421 216 511 151 978.