2021 Tax Brackets Head Of Household

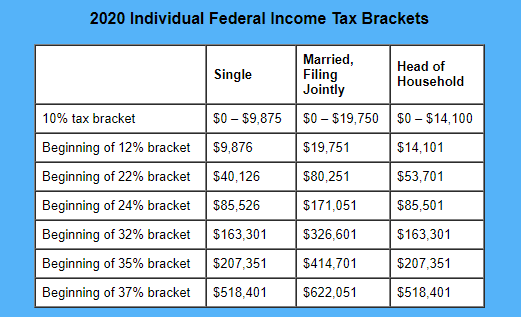

2021 tax brackets for taxes due april 15 2022 tax rate single head of household married filing jointly or qualifying widow married filing separately source.

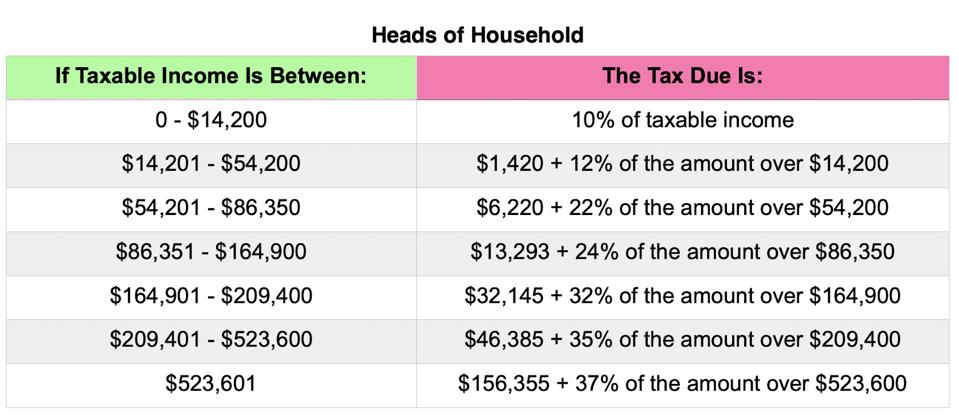

2021 tax brackets head of household. Note that joe biden wants to increase the top rate if he s elected however the. If you are wondering how much tax you ll owe when you go to file your 2020 tax return in april 2021 here s a quick guide to the 2020 u s. And here are the 2020 tax rates for the head of household which will be pertinent for taxes due on april 15 2021.

2021 federal income tax brackets for taxes due in april 2022 for individuals married filing jointly married filing separately and head of household are given below. 2021 tax brackets rate married joint return single individual head of household married separate return 10 19 900 or less 9950 or less 14 200 or less 9950 or less 12 over 19 900 over. For 2021 they re still set at 10 12 22 24 32 35 and 37.

Irs 10 0 to 9 950 0 to 14 200. For 2021 taxpayers who are at least 65 years old or blind can claim an additional standard deduction of 1 350 1 700 if using the single or head of household filing status. 2020 tax brackets due april 2021 tax rate single filers married filing jointly married filing separately head of household 10 0 9 875 0 19 750 0 9 875 0 14 100 12 9 875 40 125 19 751 80 250 9 876 40 125 14 101 53 700 22.

You can see also tax rates for the year 2020 and tax bracket for the year 2019 on this site. 2020 tax brackets for heads of household special head of household status comes if you re unmarried and provide a home and financial support for a qualifying relative most commonly a child or parent. Tax rate br income for head of household br.