Simple Ira Contribution Limits 2021 Catch Up

If you are self employed or if you are an employee with access to a simple ira you can contribute up to a maximum of 13 500 for the 2021 tax year unchanged from 2020.

Simple ira contribution limits 2021 catch up. The annual contribution limit for traditional iras will remain 6 000 in 2021. Simple ira 13 500. A simple ira or a simple 401 k plan may permit annual catch up contributions up to 3 000 in 2015 2021.

The contribution limits for simple iras isn t changing from 2020 to 2021 which means workers under 50 can put in up to 13 500 while those 50 and over get a 3 000 catch up that brings their. The contribution limit for simple retirement accounts is unchanged at 13 500 for 2021. As a result significant contributions can be made into a simple ira even at lower income levels.

Salary reduction contributions in a simple ira plan are not treated as catch up contributions until they exceed 13 500 in 2020 and 2021 13 000 in 2015 2019. The ira contribution limit for 2021 is 6 000 or your taxable income whichever is lower. Simple ira contribution limits vs.

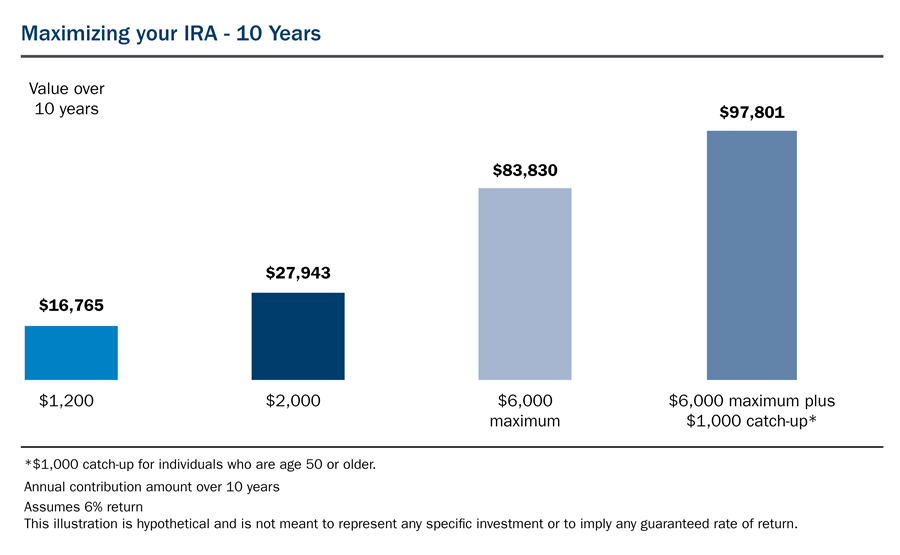

Roth contribution limits while simple ira contributions are capped at an annual limit of 13 500 annual roth ira contribution limits are much lower. Not much has changed for next year. For 2021 roth ira contributions are capped at 6 000 with an additional 1 000 allowed for catch up contributions for those 50 and older.

Ira catch up contribution 1 000. Ira limit 6 000. Self employed business owners that have a simple ira are able to contribute up to 100 of their income up to the 2020 contribution limit of 13 500 or 16 500 if age 50 or older.

For 2021 the ira contribution limit is 6 000 or 7 000 if you are at least age 50. Just about any individual with earned income can contribute to a traditional ira however their additions may not be deductible. Catch up contributions for savers who will be 50 or older by the end of 2021 let them save up to 7 000.