2021 Maximum Simple Ira Contribution Limits

The contribution limits for simple iras isn t changing from 2020 to 2021 which means workers under 50 can put in up to 13 500 while those 50 and over get a 3 000 catch up that brings their.

2021 maximum simple ira contribution limits. Employees over age 50 allowed to make a catch up contribution of up. This limit is also unchanged from 2020. Employees who are participants in employer sponsored simple ira plans can contribute 13 500 for 2021.

Here s the breakdown for the 2021 ira contribution limit changes. Not much has changed for next year. The amount an employee contributes from their salary to a simple ira cannot exceed 13 500 in 2020 and 2021 13 000 in 2019 and 12 500 in 2015 2018.

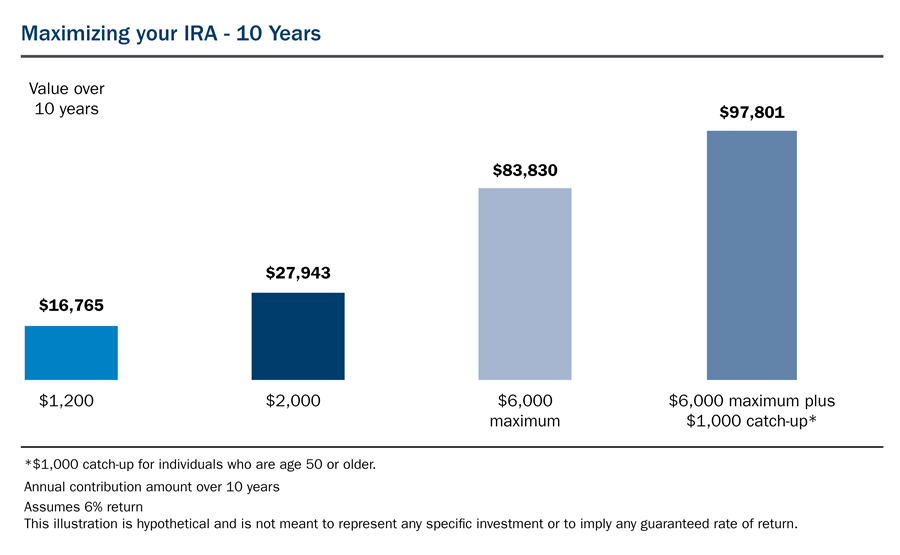

Ira limit 6 000. The contribution limit for simple retirement accounts is unchanged at 13 500 for 2021. Ira catch up contribution 1 000.

Simple ira 13 500. As a result significant contributions can be made into a simple ira even at lower income levels. Sep ira 58 000.

2020 ira contribution limits. Simple catch up 3 000. This remains unchanged from the 2020 contribution limit.

For anyone saving for retirement with a traditional or roth ira the 2021 limit on annual contributions to their ira account remains unchanged at 6 000. Ira limit 6 000. Simple ira 13 500.