New 2021 Irs Income Tax Brackets And Phaseouts

The income phaseout on contributions is 125 000 to 140 000 single and head of household 198 000 to 208 000 married filing jointly and 0 to 10 000 married filing separately.

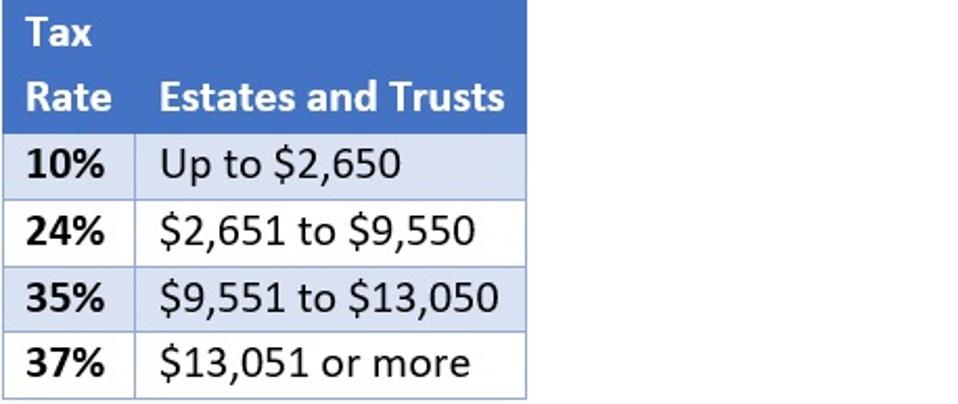

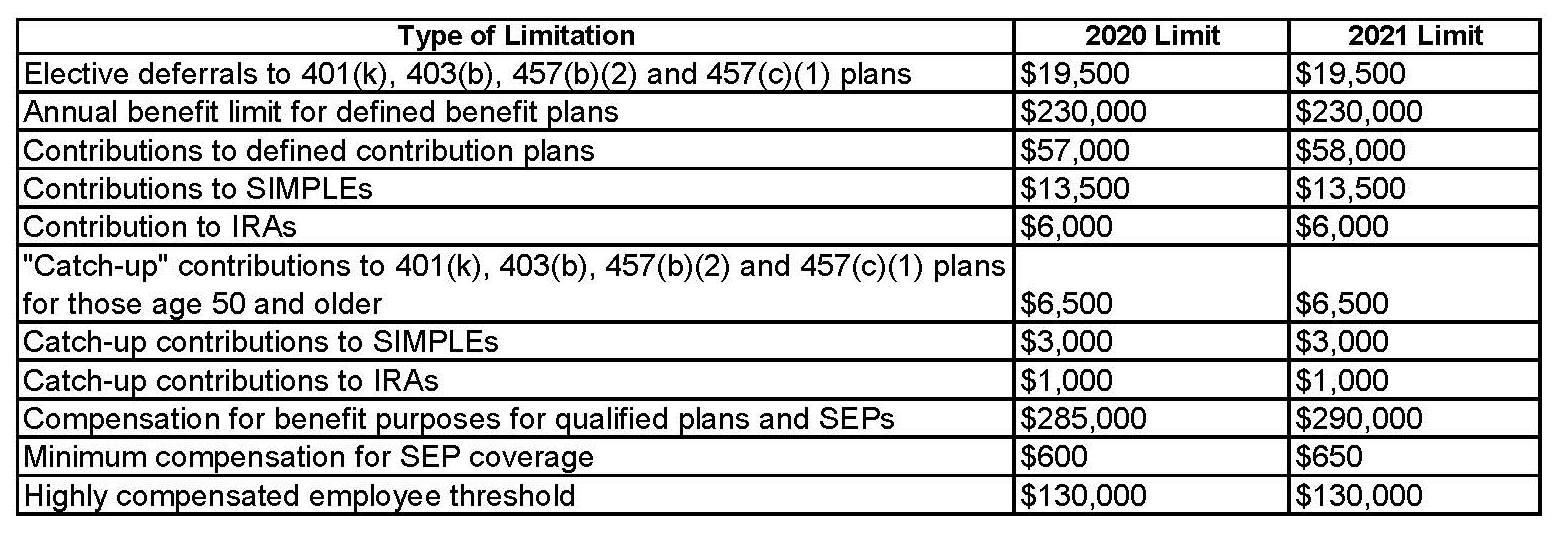

New 2021 irs income tax brackets and phaseouts. Tax brackets and tax rates. The contribution limits for 401 k 403 b and 457 plans are unchanged at 19 500 with an additional 6 500 catch up contribution limit for workers age 50 and older. 10 12 22 24 32 35 and 37 there is also a zero rate.

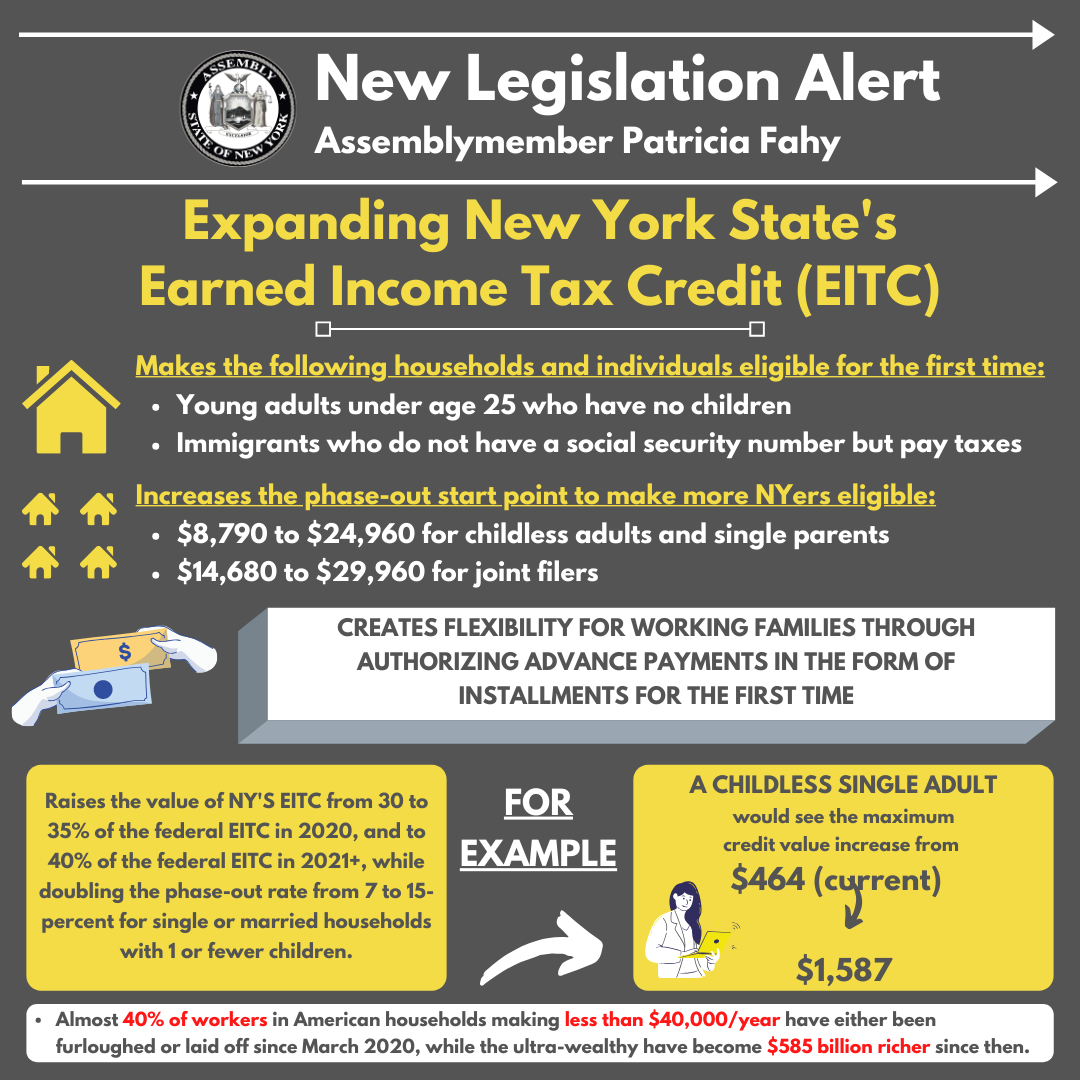

The tax year 2021 maximum earned income credit amount is 6 728 for qualifying taxpayers who have three or more qualifying children up from a total of 6 660 for tax year 2020. Each year the internal revenue service irs makes rounded inflationary adjustments to the federal income tax brackets and the income phase outs for various tax deductions and tax credits. The standard deduction is a flat dollar amount that reduces the amount of your income that s subject to tax.

Taxpayers fall into one of seven brackets. 14044 magnolia st 223 westminster ca 92683 open 9a m 6p m. Good day insurance contact us.

10 12 22 24 32. There are still seven 7 tax rates in 2021. Here s how those break out by filing status.

New 2021 irs income tax brackets and phaseouts external author nov 20 2020 each year the internal revenue service irs makes rounded inflationary adjustments to the federal income tax brackets and the income phase outs for various tax deductions and tax credits. The irs has released the 2021 tax brackets and income tax rates including tax deductions tax credits and cost of living adjustments. The irs on monday released the updated tax brackets for the 2021 filing season which have been modified to reflect inflation.

The irs has also increased the standard deduction for 2021 giving it an inflation boost. The revenue procedure contains a table providing maximum earned income credit amount for other categories income thresholds and phase outs. The income phaseout on contributions is 125 000 to 140 000 single and head of household 198 000 to 208 000 married filing jointly and 0 to 10 000 married filing separately.