Income Tax Brackets 2021 Australia

If your taxable income is less than 66 667 00 you will get the low income tax offset.

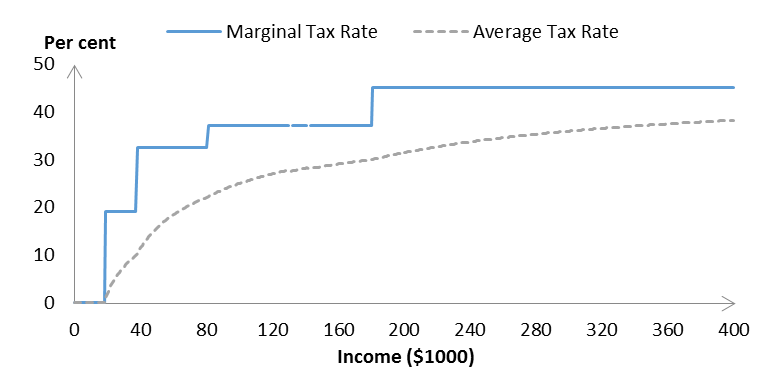

Income tax brackets 2021 australia. 51 667 plus 45 cents for each 1 over 180 000. 29 467 plus 37c for each 1 over 120 000. From 2020 21 the upper limit of the 19 personal income tax bracket will rise to 45 000 and the 32 5 marginal tax rate upper threshold will lift from.

Tax on this income. The tax free threshold may effectively be higher for taxpayers eligible for the low income tax offset the seniors and pensioners tax offset and or certain other tax offsets. In australia financial years run from 1 july to 30 june of the following year so we are currently in the 2020 21 financial year 1 july 2020 to 30 june 2021.

5 092 plus 32 5 cents for each 1 over 45 000. Personal income tax pit rates. The following rates apply to individuals who are not residents of australia for tax purposes for the entire income year.

Increasing the top threshold of the 19 personal income tax bracket from 37 000 to 45 000 providing up to 1 080 in tax relief. That stage has not been brought forward. The maximum tax offset of 700 00 applies if your taxable income is 37 000 00 or less.

51 667 plus 45c for each 1 over 180 000. Increasing the threshold of the 32 5 tax bracket from 90 000 to 120 000 providing up to 1 350 in tax relief. 19 cents for each 1 over 18 200.

19c for each 1 over 18 200. Tax rates and codes you can find our most popular tax rates and codes listed here or refine your search options below. 29 467 plus 37 cents for each 1 over 120 000.