2021 Income Tax Brackets Ontario

For 2021 in canada except quebec the maximum annual insurable earnings are 56 300 and the ei premium rate is 1 58 for a maximum annual premium of 889 54.

2021 income tax brackets ontario. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. Bloomberg tax accounting has projected 2021 income ranges for each tax rate bracket. Choose your province or territory below to see the combined federal provincial territorial marginal tax rates.

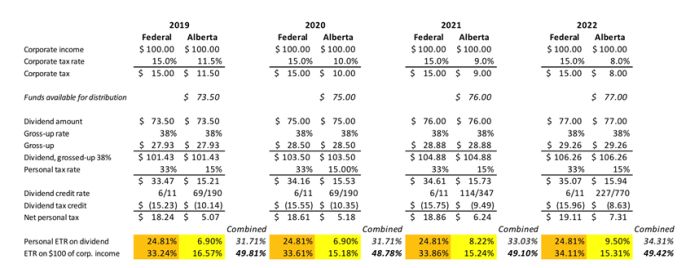

Ontario personal income tax brackets and tax rates. Over 44 740 up to 89 482. For nonresident corporations the general corporation rates in the table apply to business income attributable to a permanent establishment in canada.

54 100 for a head. Fixed ranges are commonly used to tax income applying different actions normally percentages tax dependant on your taxable income. In quebec the premium rate is 1 18 for a maximum annual premium of 664 34.

Over 90 287 up to 150 000. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly. 2020 combined federal and ontario corporate income tax rates.

Eligible dividends are those paid by public corporations and private companies out of earnings that have been taxed at the general corporate tax rate. For example income bracket 15 000 00 20 000 00. For 2021 the maximum zero rate amount on adjusted net capital gains for married persons will be 80 800 for joint returns and 40 400 for married individuals separate returns.

Click here for 2020 s tax brackets. Income ranges for the tax brackets for married taxpayers filing jointly and for single taxpayers are shown below. Over 45 142 up to 90 287.