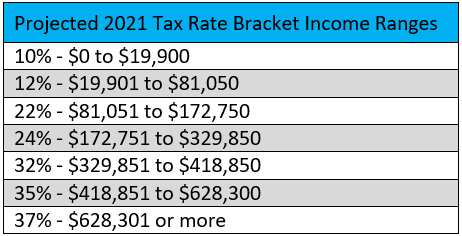

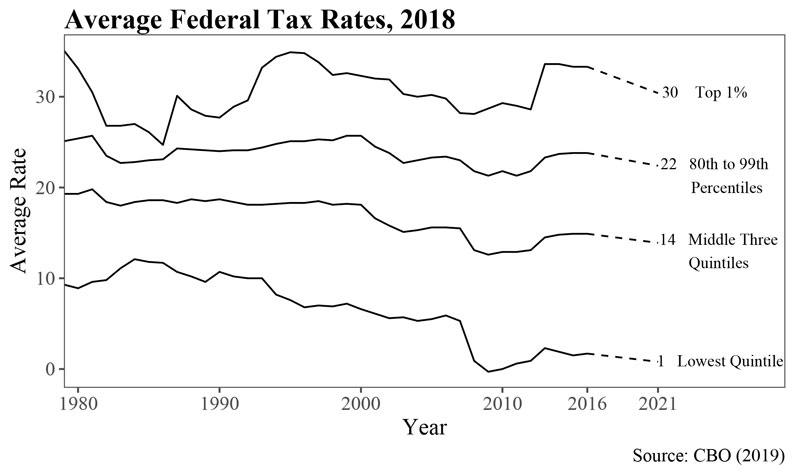

Projected 2021 Tax Brackets

From 2020 to 2021 most inflation adjusted amounts in the tax code including the threshold dollar amounts for tax rate brackets are projected to rise by about 1.

Projected 2021 tax brackets. As with income tax rates capital gains rates will not change for 2021 but the brackets for the rates will change. Since no changes in the tax law is expected to occur the tax brackets will work the same in 2021. Tax code amounts that are.

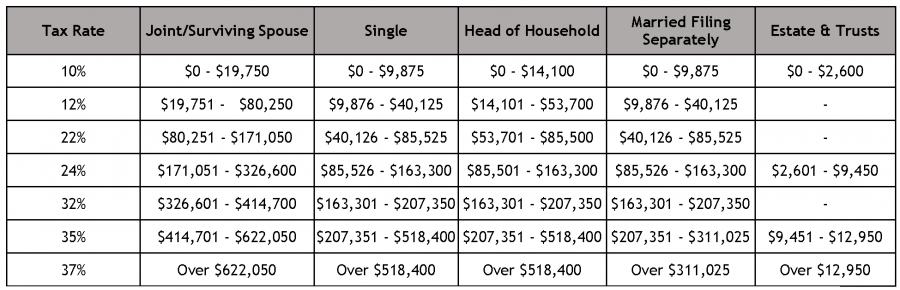

In the above example the taxpayer will not exactly pay 22 of his agi in taxes. The top of the 24 bracket for single filer will be 164 925. Instead of thinking tax brackets as something that will take a specific portion of your income think of them as pockets you need to fill.

A few notable items. These amounts were 7 030 10 540 and 14 800 for 2020 respectively. 2021 standard deduction will be 25 100 mfj and 12 550 single the top of the 24 bracket for mfj filer will be 329 850.

Most taxpayers pay a maximum 15 rate but a 20 tax rate applies to the extent. The irs also announced that the standard deduction for tax year 2021 will increase by 300 to 25 100 for married couples filing jointly and by 150 to 12 550 for single individuals and married. 2021 federal income tax brackets and rates in 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.

Projected 2021 tax rate bracket income ranges 10 0 to 19 900 12 19 901 to 81 050 22 81 051 to 172 750 24 172 751 to 329 850 32 329 851 to 418 850 35 418 851 to 628 300 37 628 301 or more. Similarly other brackets for income earned in 2021 have been adjusted upward as well. In tax year 2020 for example a single person with taxable income up to 9 875 paid 10 percent while in 2021 that income bracket rises to 9 950.

Bloomberg tax accounting recently published projected 2021 federal tax brackets.