2021 Ira Catch Up Contribution Limits

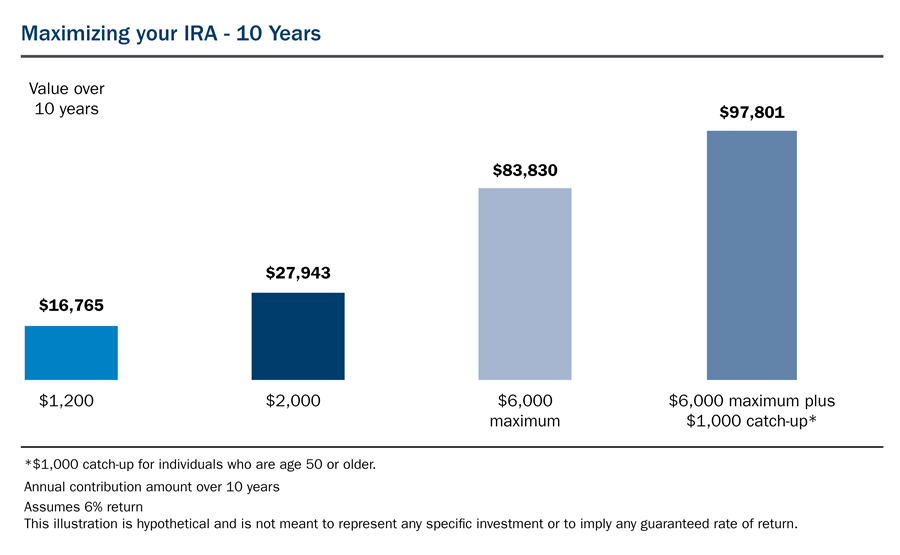

The ira contribution limit is 6 000.

2021 ira catch up contribution limits. The ira catch up contribution limit will remain 1 000 for those age 50 and older. 6 000 7 000 if you re age 50 or older or. The ira catch up contribution limit will remain 1 000 for those age 50 and older.

The ira contribution limit for 2021 is 6 000 or your taxable income whichever is lower. Catch up contributions for savers who will be 50 or older by the end of 2021 let them save up to 7 000. This is known as the catch up contribution totaled with that the 2021 ira.

But this doesn t mean you can t contribute more than 6 500. Traditional or roth 401 k 19 500. 415 c annual additions limits for 401 a plans will increase from 57 000 to 58 000.

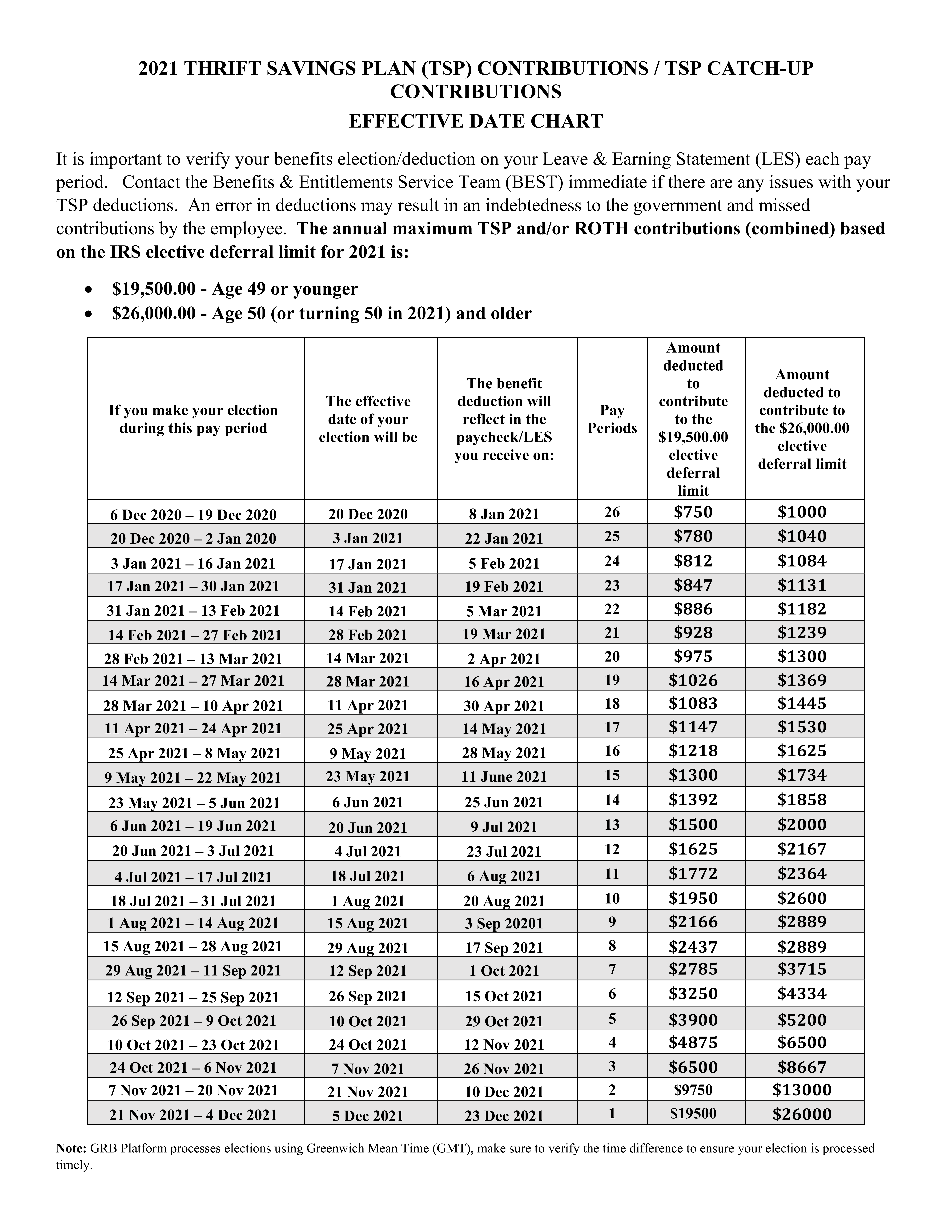

The catch up contribution limit for employees age 50 or older who participate in these plans also holds steady in 2021 at 6 500 for a total contribution limit of 26 000 for employees 50 and. Traditional or roth ira. If less your taxable compensation for the year.

The 500 increase means the contribution limit is increased to 6 500. For 2021 2020 and 2019 the total contributions you make each year to all of your traditional iras and roth iras can t be more than. If you re age 50 or older you get an additional 1 000 to contribute.

401 k participants with incomes below. The tables below. More details on the retirement plan limits are available from the irs.