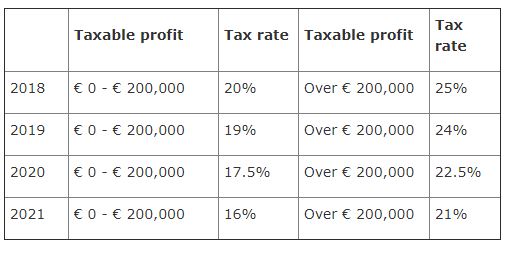

Tax Brackets Netherlands 2021

The standard rate will decrease from 25 in 2020 to 21 7 in 2021.

Tax brackets netherlands 2021. Taxable amount of 200 000 and above was taxed at a 25 tax rate. The dutch tax system especially for expats is anything but simple. Income tax rates in holland per year and with additional information about tax brackets credits allowances and related income.

On 15 december 2020 the senate adopted the 2021 tax plan and the legislative proposals that were presented on budget day. Netherlands 2020 employee social security rates and thresholds annual insurance resident tax rate non resident tax rate cap aow old age insurance 17 9 17 9 34 300 00 anw survivor dependant insurance 0 1 1 34 300 00 wlz long medical. As both rates have come down a lot of people will benefit from higher net salaries.

Personal income tax rate in netherlands averaged 53 74 percent from 1995 until 2020 reaching an all time high of 60 percent in 1996 and a record low of 49 50 percent in 2020. The income tax cuts are directed at low and middle income individuals and will impact roughly 7 2 million of sweden s 10 3 million population. Earnings up to 68 507 will be taxed at 37 35 while earnings over that limit will be taxed at 49 5.

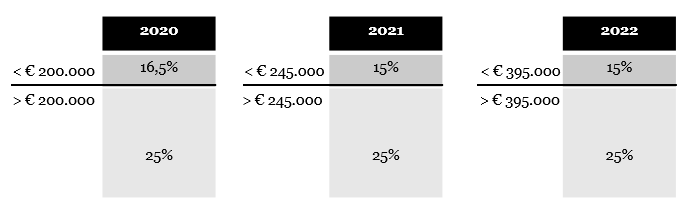

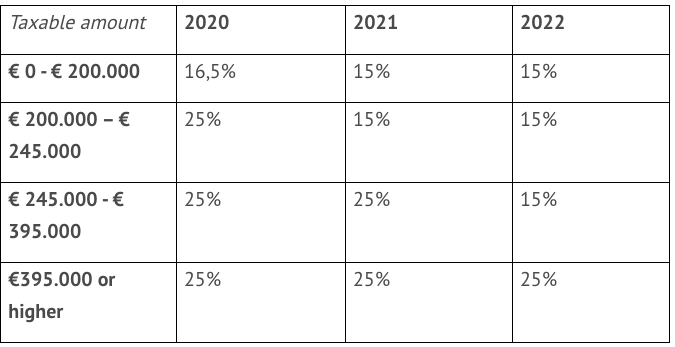

2021 rates for box 1 income taxable income eur tax on column 1 eur tax on excess over column 1 not over 0 35 129 9 45 35 129 68 507 3 319 37 10 68 507 15 702 49 50 in the first bracket of box 1 national insurance tax is levied at a rate of. The lower rate will further decrease from 16 5 in 2020 to 15 in 2021. The cit rates will be reduced.

The personal income tax rate in netherlands stands at 49 50 percent. The netherlands is a socially conscious country. The standard rate applies to the excess of the taxable income.

Taxation in the netherlands is based on a box system whereby each box contains certain income which is taxed against a certain tax rate with tax brackets credits allowances fixed rates etc. However once you understand it you will be able to easily navigate it. Resulting in a 16 tax rate in the first bracket and 21 tax rate in the second bracket.

.jpg)