2021 Wisconsin Tax Brackets

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household.

2021 wisconsin tax brackets. Similarly other brackets for income earned in 2021 have been adjusted upward as well. Wisconsin single tax brackets tax year. The wisconsin tax brackets on this page have been updated for tax year 2020 and are the latest brackets available.

Tennessee s hall tax which applies to investment income but not to wage income is continuing to phase out with the rate dropping from 2 to 1. These brackets reflect adjustments for inflation and will be applied to the 2021 tax filing year. An application may also be obtained by contacting any of our local offices or by calling 608 266 2776.

Wisconsin state income tax rate table for the 2020 2021 filing season has four income tax brackets with wi tax rates of 3 54 4 65 6 27 and 7 65. 2020 2021 wisconsin state state tax refund calculator calculate your total tax due using the tax calculator update to include the 2020 2021 tax brackets. These income tax brackets and rates apply to wisconsin taxable income earned january 1 2020 through.

Deduct the amount of tax paid from the tax calculation to provide an illustration of your 2020 2021 tax. If you register. 2020 wisconsin tax brackets and rates for all four wi filing statuses are shown in the table below.

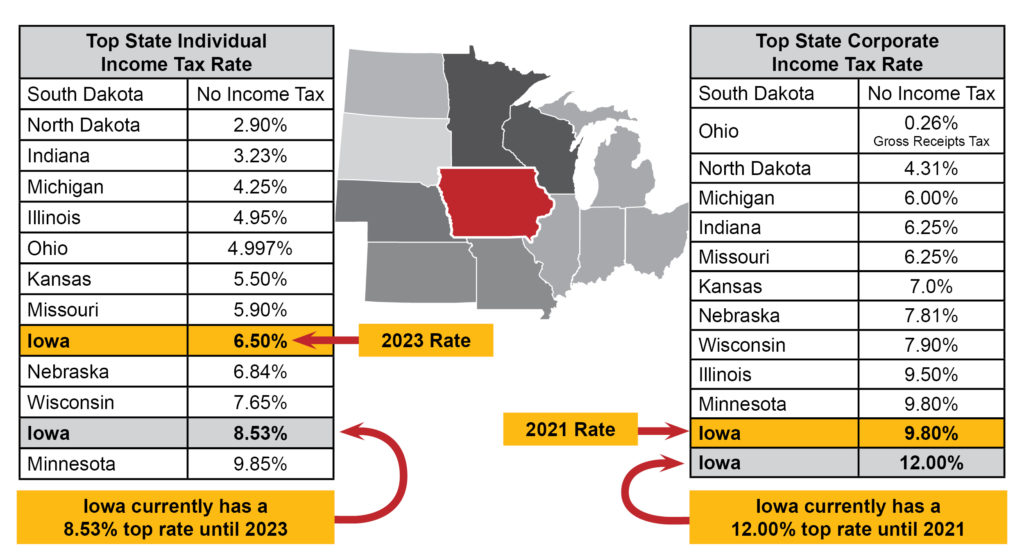

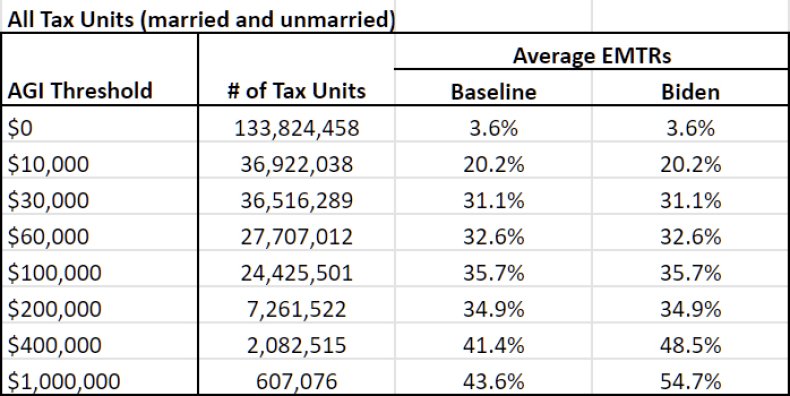

2020 due date. But a win by democrat presidential candidate joe biden in november will change these brackets. American taxpayers have been categorized into one of seven brackets depending on income.

Indexing of the brackets was frozen at 2018 levels for tax years 2019 and 2020 but is set to resume in 2021. States often adjust their tax brackets on a yearly basis so make sure to check back later for wisconsin s updated tax year 2021 tax brackets. April 15 2021 the wisconsin single filing status tax brackets are shown in the table below.