2021 Income Tax Brackets Head Of Household

Note that joe biden wants to increase the top rate if he s elected however the.

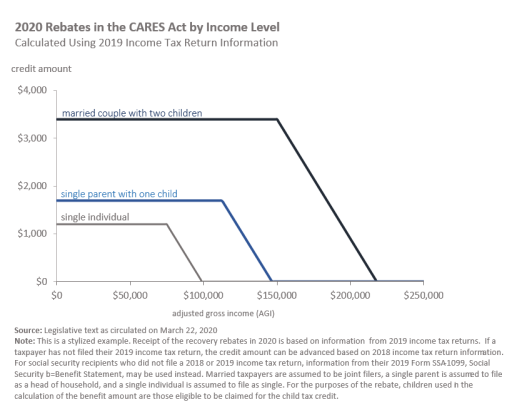

2021 income tax brackets head of household. 9950 or less. Capital gains and qualified dividends for 2021 long term capital gains and qualified dividends face the following tax rates. This article covers rates for tax returns for 2020 income for returns due in 2021.

2021 federal income tax brackets for taxes due in april 2022 for individuals married filing jointly married filing separately and head of household are given below you can see also tax rates for the year 2020 and tax bracket for the year 2019 on this site. Rate for unmarried individuals for married individuals filing joint returns for heads of households. Second it depends on your taxable income.

But if you ve qualified for head of household the income is 0 13 850. The tax rates haven t changed since 2018. In general there are seven tax brackets for ordinary income 10 12 22 24 32 35 and 37 with the bracket determined by filers taxable income.

The internal revenue service announced the new tax rates for the tax year 2021 on 26th october 2020. The second bracket which gets taxed 12 goes up to 52 850 for the head of household. 0 tax rate if they fall below 80 800 of taxable income if married filing jointly 54 100 if head of household or 40 400 if filing as single or married filing separately.

2021 federal income tax rates. 2021 federal income tax brackets and rates for single filers married couples filing jointly and heads of households. Then taxable rate within that threshold is.

Individual married filing jointly married filing separately and head of household. First you must determine your filing status. Tax brackets and rates for 2021 for returns due in 2022 are also included.