Us Federal Income Tax Brackets 2021

Your bracket depends on your taxable income and filing status.

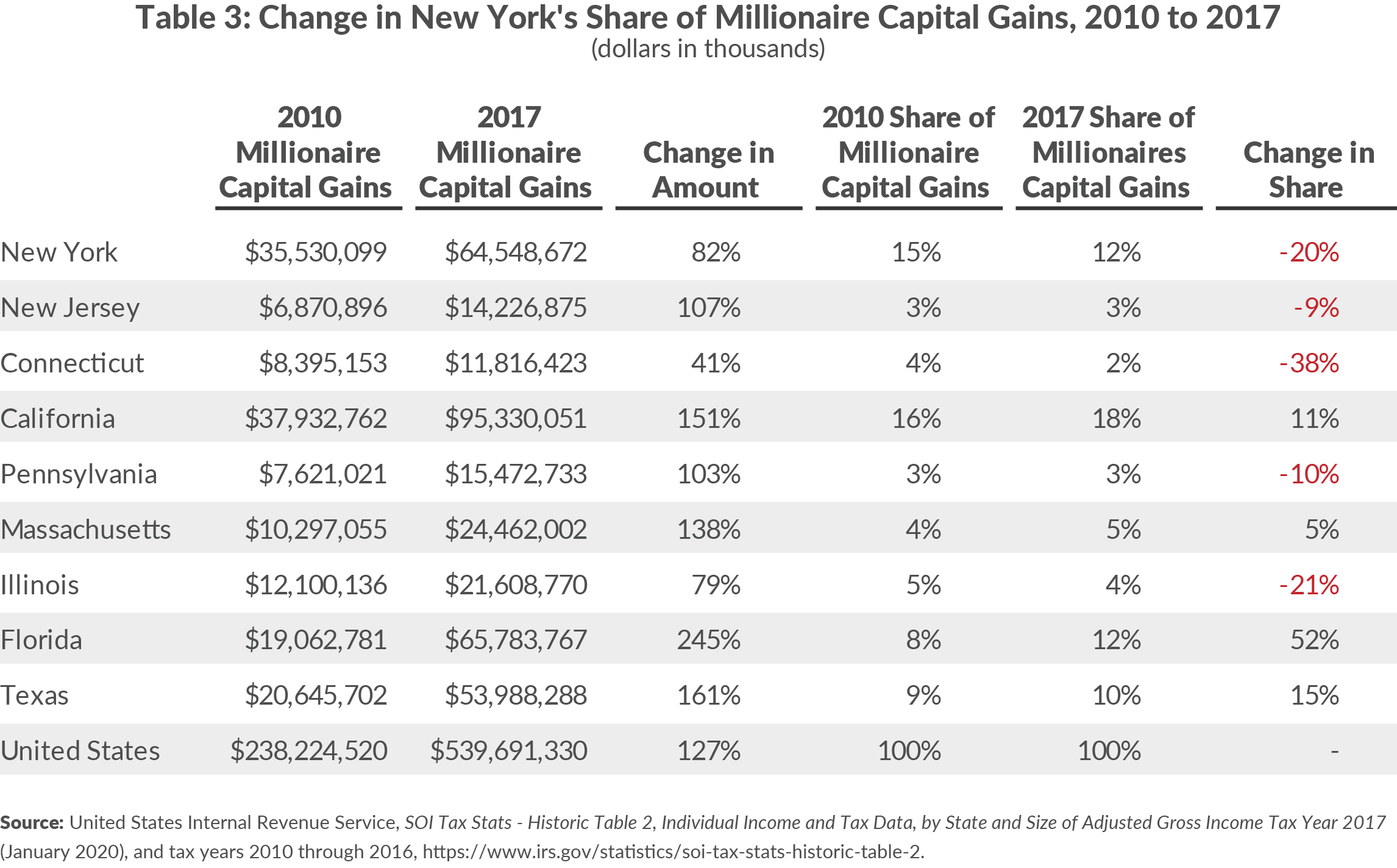

Us federal income tax brackets 2021. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The bottom rate is 10 while the top rate has fallen from 39 6 to 37 from 2017 federal income tax bracket system. If taxable income is.

Each year the irs adjusts the tax brackets for inflation. The tax year 2021 tax brackets are also already available. The standard deduction for married couples filing jointly for tax year 2021 rises to 25 100 up 300 from the prior year.

2021 federal income tax brackets and rates in 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. The 2018 federal income tax brackets also houses the same seven different taxation rates. There are still seven 7 tax rates in 2021.

For unmarried individuals the prices will get expired in 2025 unless congress decides on extending it. 2021 federal income tax rates. Married individuals filling seperately.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly. There are seven federal tax brackets for the 2020 tax year. There are seven tax brackets for most ordinary income.

Here s an explanation for how we make money. 10 12 22 24 32 35 and 37. Here s how those break out by filing status.