2021 Income Tax Brackets Canada

Canadian corporate tax rates for active business income.

2021 income tax brackets canada. 10 0 to 19 900. The additional 0 21 is calculated as 15 x 13 808 12 421 216 511 151 978. 5 05 on the first 44 740 of taxable income 9 15 on the next 44 742 11 16 on the next 60 518 12 16 on the next 70 000 13 16 on the amount over 220 000.

Each of the tax tables listed is fully integrated into the canadian tax return calculator a free online tax calculator designed to help completing your tax return straight forward. 24 172 751 to 329 850. 35 418 851.

32 329 851 to 418 850. The above tables do not include medicare levy or the effect of low income tax offset lito or lmito under changes outlined in budget 2020 the low income tax offset up to 700 is to apply from 1 july 2020 previously 2022 and the low and middle income tax offset up to 1 080 is retained. Go to income tax rates revenu québec web site.

22 81 051 to 172 750. 2020 includes all rate changes announced up to july 31 2020. Calculate the tax savings your rrsp contribution generates.

12 19 901 to 81 050. As economic pressure mounts the canada revenue agency cra and the federal government may introduce big changes in 2021. The federal marginal rate for 2021 for 151 978 to 216 511 is 29 21 because of the above noted personal amount reduction through this tax bracket.

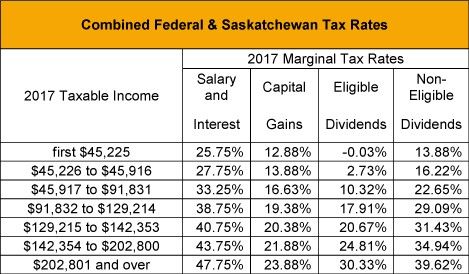

Canada tax tables federal and province 2020 2021 tax tables this page contains the latest federal and province tax tables for canada. Choose your province or territory below to see the combined federal provincial territorial marginal tax rates. The marginal federal tax rate is 26 percent until you make more than 147 667 when your marginal rate rises to 29.