2021 Nj Income Tax Brackets

The irs also announced that the standard deduction for tax year 2021 will increase by 300 to 25 100 for married couples filing jointly and by 150 to 12 550 for single individuals and married.

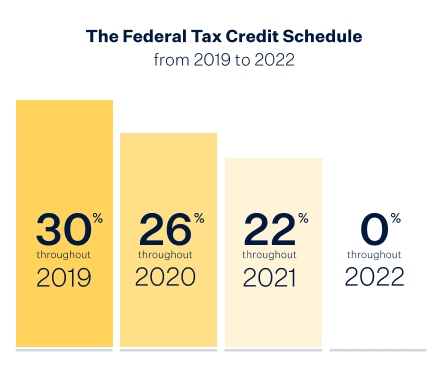

2021 nj income tax brackets. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly. There are basically two ways to get into a lower. Capital gains rates will not change for 2021 but the brackets for the rates will change.

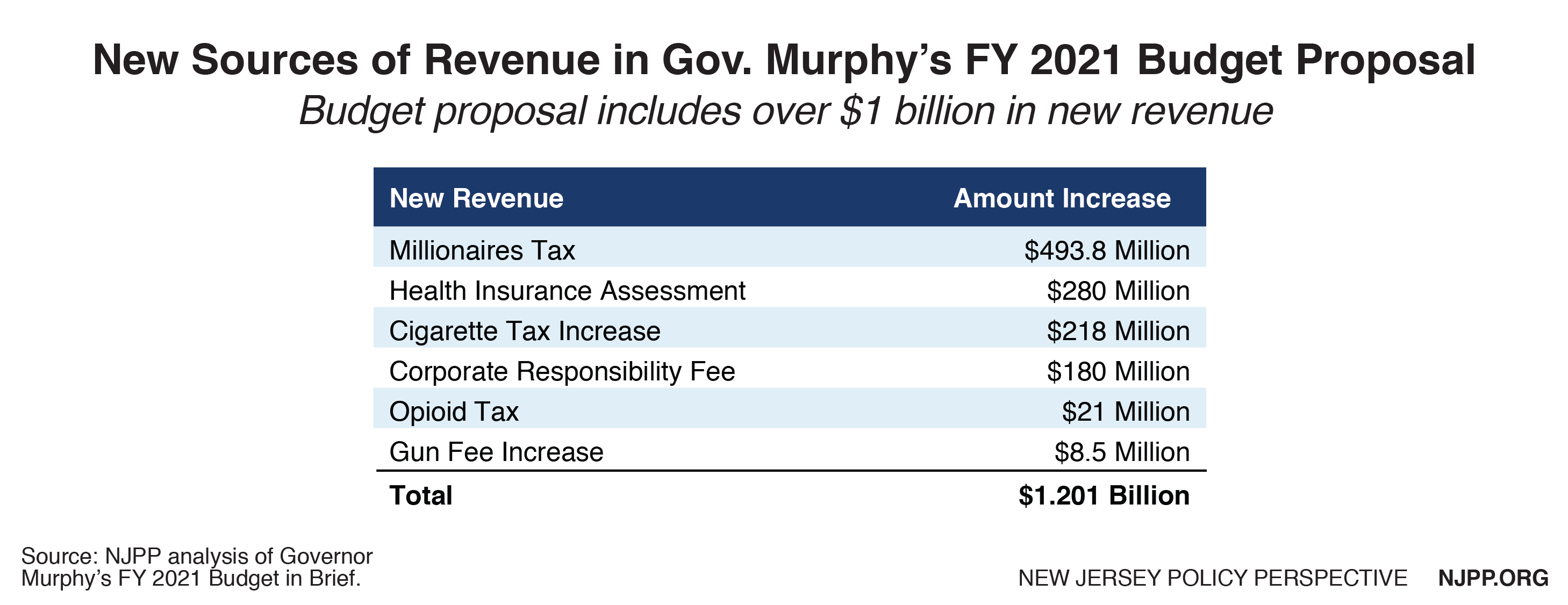

The brackets are adjusted each year for inflation. The brackets above show the tax rates for 2020 and 2021. New jersey state income tax rate table for the 2020 2021 filing season has seven or eight income tax brackets with nj tax rates of 1 4 1 75 2 45 3 5 5 525 6 37 8 97 10 75 for single married filing jointly married filing separately and head of household statuses.

There are low income and other full or partial medicare exemptions available. For 2021 returns filed by individual taxpayers in 2022 the top tax rate will continue to be 37 but the standard deduction tax bracket ranges other deductions and phase outs will increase. Click here for 2020 s tax brackets.

New jersey has seven marginal tax brackets ranging from 1 4 the lowest new jersey tax bracket to 10 75 the highest new jersey tax bracket. How to get into a lower tax bracket. For 2021 the top tax rate of 37 will apply to individual.

The above tables do not include medicare levy or the effect of low income tax offset lito or lmito under changes outlined in budget 2020 the low income tax offset up to 700 is to apply from 1 july 2020 previously 2022 and the low and middle income tax offset up to 1 080 is retained. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in new jersey for single filers and couples filing jointly. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.

These rates are in effect for 2021 and will affect the returns you file for that year in 2022.