2021 Hsa Contribution Limits Over 55

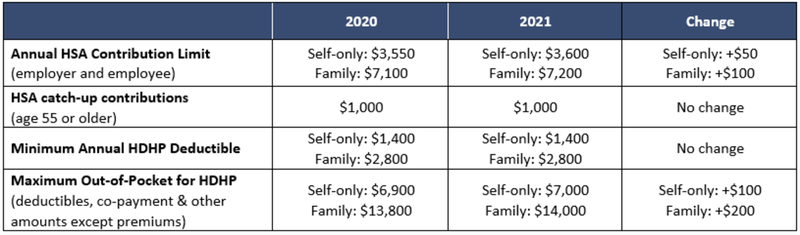

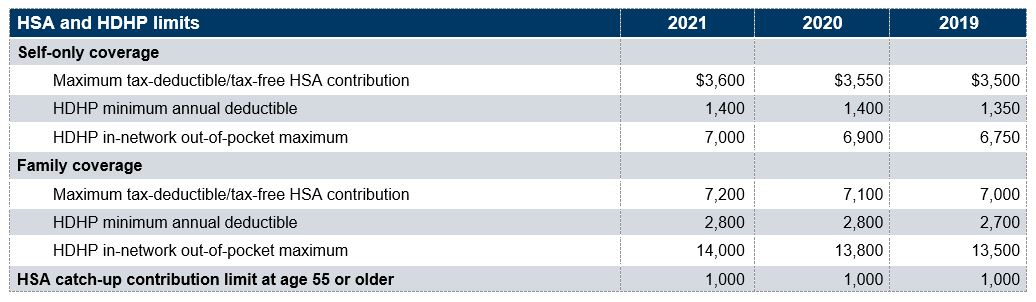

Maximum contribution levels individual coverage 3 6 0 0 3 550 family coverage 7 200 7 100 catch up allowed for those 55 and over 1 000 1 000 maximums for hdhp out of pocket expenses individual coverage 7 000 6 900 family coverage 14 000 13 800 2021 contribution limits.

2021 hsa contribution limits over 55. Because any unused money in your hsa rolls over from year to year. The irs announced higher hsa limits for the 2021 tax year which means opportunity to save even more. Below are the limits for contributions deductibles and out of pocket maximums for hsas.

2021 maximum hsa contributions. For participants age 50 and over the additional 401 k catch up contribution limit which is set by law is staying at 6 500 for 2021. Because of the hsa catch up contribution.

2021 hsa contribution limits over 55 for 2020 your individual 401 k contribution limit is 19 500 or 26 000 if you re age 50 or older. Those 55 or older can contribute an extra 1 000 and this is shown in the fourth column. 2021 hsa contribution limits over 55.

401 k catch up contribution limit. The contribution limit which is the total you can contribute in 2018 if you are under 55. Hsa investing when you re over 65 contribution limits.

Hsa limits 2021 summary. Health savings account limits for 2021. Annual hsa contribution limit for individuals.

55 plus can contribute an extra 1 000. If you re 55 or older at the end of the year you can contribute an extra 1 000. If you turn age 55 by december 31 2021 you can contribute an additional 1 000.