Fy 2021 Tax Brackets

Tailored tax rates for salary wages and pensions you can get a tailored tax rate for income you get from.

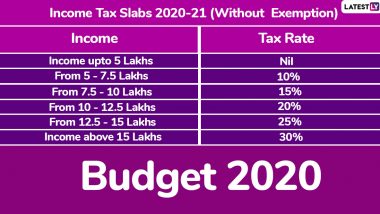

Fy 2021 tax brackets. Income tax brackets in india for fy 2020 21 ay 2021 22 updated on december 18 2020 14914 views paying income tax is a duty of every indian citizen. 2 50 000 rs 5 00 000 5 4 cess 5 4 cess rs 5 00 000 rs. The current tax year is from 6 april 2020 to 5 april 2021.

Tax rates and codes you can find our most popular tax rates and codes listed here or refine your search options below. If we approve your application we ll let you. 10 00 000 20 4 cess 20 4 cess rs 10 00 000 rs 50 00 000 30 4 cess.

The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. Your tax free personal allowance the standard personal allowance is 12 500 which is the amount of income you do not have to pay tax on. Tax rates 2020 2021 year residents the 2021 financial year starts on 1 july 2020 and ends on 30 june 2021.

Salary or wages new zealand superannuation veteran s pension. This means that these brackets applied to all income earned in 2020 and the tax return that uses these tax rates was due in april 2021. Under the income tax act 1961 the percentage of income payable as tax is based on the amount of.

Tax rate fy 2019 20 ay 2020 21 tax rate fy 2018 19 ay 19 20 up to 2 5 lakhs no tax no tax rs. Federal income tax brackets were last. Resident tax rates 2020 21 taxable income tax on this income 0 18 200 nil 18 201 45 000 19 cents for each 1 over 18 200 45 001 120 000 5 092 plus 32 5 cents for each 1 over 45 000 120 001 180 000 29 467 plus 37 cents for each 1 over.

2021 tax year 1 march 2020 28 february 2021 see the changes from the previous year taxable income r rates of tax r 1 205 900 18 of taxable income 205 901 321 600 37 062 26 of taxable income above 205 900 321 601 445 100 67 144. Paye tax rates and thresholds 2020 to 2021 employee personal allowance 240 per week 1 042 per month 12 500 per year english and northern irish basic tax rate 20 on annual earnings above the.