Tax Brackets 2021 Washington

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household.

Tax brackets 2021 washington. The federal government uses a. 2021 washington tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Most taxpayers pay a maximum 15 rate but a 20 tax rate applies to the extent.

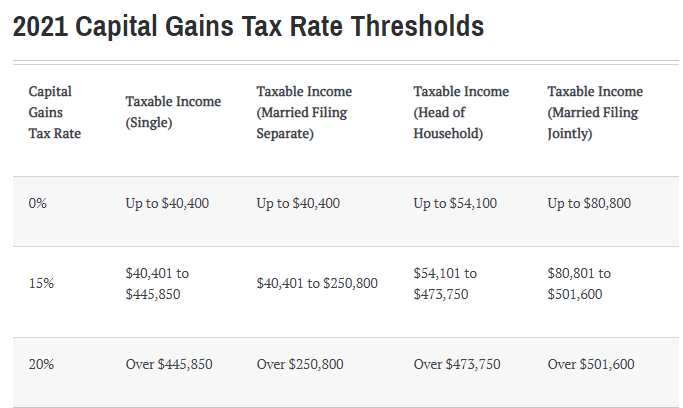

Or october 15 2021 if you apply for an automatic filing but not paying extension which means you account for. In general there are seven tax brackets for ordinary income 10 12 22 24 32 35 and 37 with the bracket determined by filers taxable income. As with income tax rates capital gains rates will not change for 2021 but the brackets for the rates will change.

2021 federal income tax brackets and rates in 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. Below are the tax rates for the 2021 filing season for three common filing statuses. Dollar amounts represent taxable income earned in 2020.

2021 federal tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Upcoming tax brackets tax rates for 2020 note. How tax brackets work in general there are seven tax.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of. Federal income tax brackets were last. This can get a bit confusing.

States often adjust their tax brackets on a yearly basis so make sure to check back later for washington s updated tax year 2021 tax brackets. The washington tax brackets on this page have been updated for tax year 2020 and are the latest brackets available. The alternative minimum tax exemption amount for tax year 2021 is 73 600 and begins to phase out at 523 600 114 600 for married couples filing jointly for whom the exemption begins to phase out at 1 047 200.