Tax Brackets 2021 To 2022

2021 2022 tax brackets by filing status.

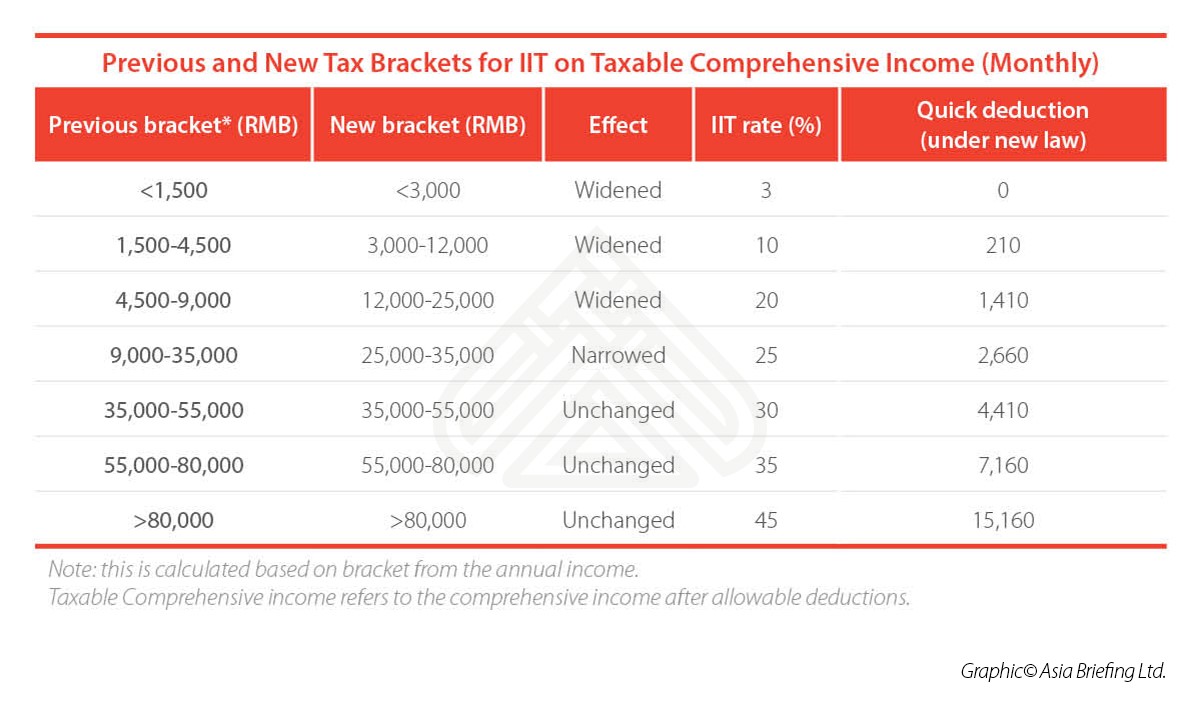

Tax brackets 2021 to 2022. Keep in mind you might be able to reduce your taxable income and or increase your tax free income and as a result fall into lower a tax bracket once you factor in tax deductions tax credits or other tax savings factors. Tax rates 2021 2022 year residents the 2021 financial year starts on 1 july 2021 and ends on 30 june 2022. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

These are the numbers that you ll use to prepare your 2021 tax returns in 2022. This was the case with the tax cuts and jobs act. These rates will go into effect for 2021 and will be employed to prepare your tax returns in 2022.

American taxpayers have been categorized into one of seven brackets depending on income. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year.

These are the 2020 brackets. Here are the new brackets for 2021 depending on your income and filing status. Having said that the earliest any major tax changes are likely to happen would be for the 2022 tax year the first full year biden is in office.

The first round of scheduled tax changes under tcja will occur in 2021 and 2022 when several business tax provisions are set to go into effect. 2020 tax brackets and rates. This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax rates was due in april 2022.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly. For 2021 the top tax rate of 37 will apply to individual taxpayers with income over 523 600 628 300 for married filing jointly. After 2021 businesses will be required to deduct research and experimentation costs over five years rather than being able to deduct the full cost immediately.