Tax Brackets 2021 New York

With two months left in 2020 the irs has released the new tax brackets for 2021.

Tax brackets 2021 new york. New york collects a state income tax at a maximum marginal tax rate of spread across tax brackets. They are not the numbers and tables that you ll use to prepare your 202o tax returns in 2021 you ll find them here. Here are the 2020 income tax brackets for.

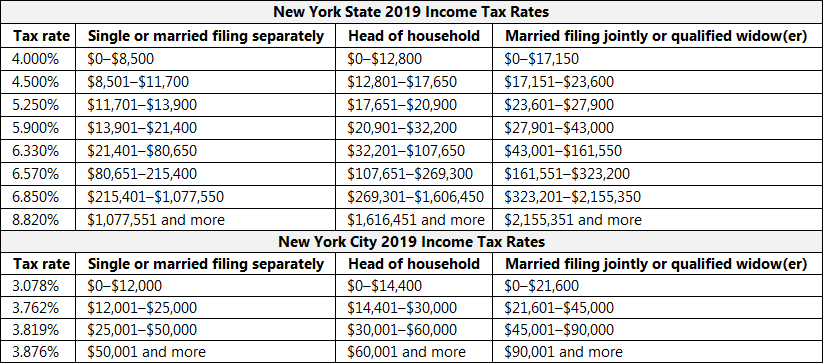

Where you fall within these brackets depends on your filing status and how much you earn annually. 2020 new york tax brackets and rates for all four ny filing statuses are shown. New york has eight marginal tax brackets ranging from 4 the lowest new york tax bracket to 8 82 the highest new york tax bracket.

Click here for 2020 s tax brackets. 2021 new york tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. You can also add a copy of the new york tax reform calculator to your won website to allow your users to use the tool whilst browsing your new york tax advice new york tax refund articles etc.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household. New york state income tax rate table for the 2020 2021 filing season has eight income tax brackets with ny tax rates of 4 4 5 5 25 5 9 6 09 6 41 6 85 and 8 82. For 2021 the top tax rate of 37 will apply to individual taxpayers with income over 523 600 628 300 for married filing jointly.

Once again there are seven tax brackets. More from smart tax. They re adjusted every year to account for inflation.

Tax brackets generally change every year and the brackets for 2020 income taxes those filed by april 2021 have been released. The federal tax rates have been updated to the 2020 2021 forecast tax tables and the tax calculator now uses the 2020 2021 tax tables as default. Each marginal rate only applies to earnings within the applicable marginal tax bracket.