Stimulus Checks Advance On 2021

For now we re waiting to see what happens with the second stimulus check while keeping an eye to early 2021.

Stimulus checks advance on 2021. For single filers the income phaseout starts at 75 000. Here s everything we know right now about the chances of a third stimulus check in 2021. There s a self imposed jan.

15 2021 cutoff for the irs to send this second batch of stimulus checks which means once again the clock is ticking for the agency to gather its data and act. The advance you ve been hearing about is in reference to a special tax credit that ll appear on the tax return you file in 2021 for the 2020 tax year a tax credit that wouldn t have been there. So the internal revenue service isn t giving you some of your 2020 tax refund upfront.

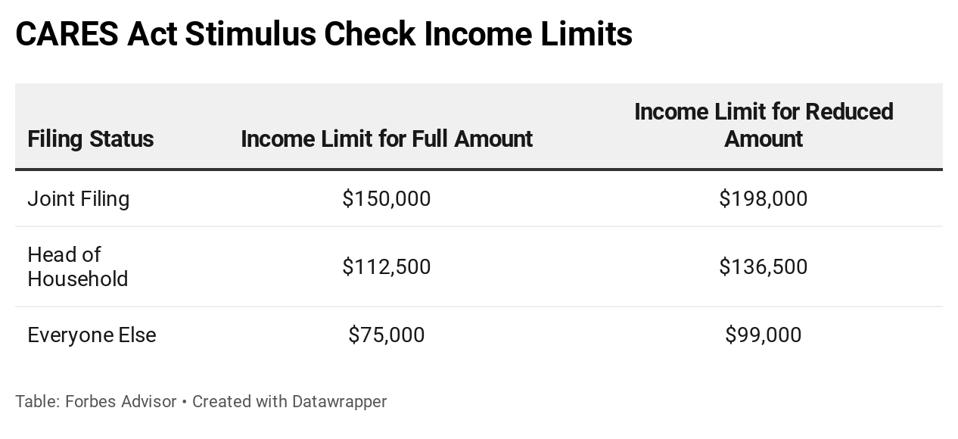

The stimulus check is reduced by 5 of your adjusted gross income above the start of the income phaseout. Is a third stimulus check in 2021 possible. The advance you ve been hearing about is in reference to a special tax credit that ll appear on the tax return you file in 2021 for the 2020 tax year a tax credit that wouldn t have been there if it wasn t for these stimulus checks.

Discussions over a second stimulus relief package as well as the direct payment. In theory yes it s possible to see another stimulus check in 2021. Explainers and faqs focused primarily on who would receive which amount but were light on any reference to what effects if any the stimulus payments might have on future tax refunds.

For more information on stimulus checks here s how you might get more money in your. President elect joe biden doesn t take office until jan. Cnet reports that should the bill gain approval individuals will most likely receive their relief by february 2021.

The ins and outs start getting complicated but there are three essential things to. For joint filers the income. Unfortunately language of the bill was not very clear on whether coronavirus stimulus checks distributed via the irs would be deducted from anticipated 2021 refunds for the 2020 tax year.