Simple Ira Contribution Limits For 2021

The simple catch up limit is still 3 000.

Simple ira contribution limits for 2021. The amount an employee contributes from their salary to a simple ira cannot exceed 13 500 in 2020 and 2021 13 000 in 2019 and 12 500 in 2015 2018. This is the same as the 2020 limit but an increase from 2019 s limit of 13 000 and an even bigger leap from the 12 500 limit imposed from 2015 to 2018. This remains unchanged from the 2020 contribution limit.

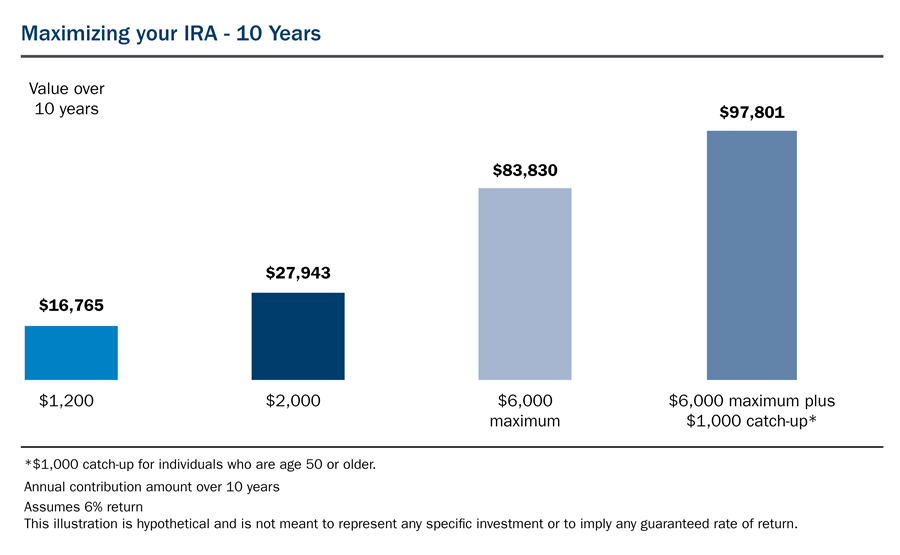

Additionally any eligible employee that will attain the age of 50 by december 31 2021 can defer an additional 3 000 for a total of 16 500.

Source : pinterest.com