Simple Ira 2021 Contribution Limit Irs Catch Up

Here s the breakdown for the 2021 ira contribution limit changes.

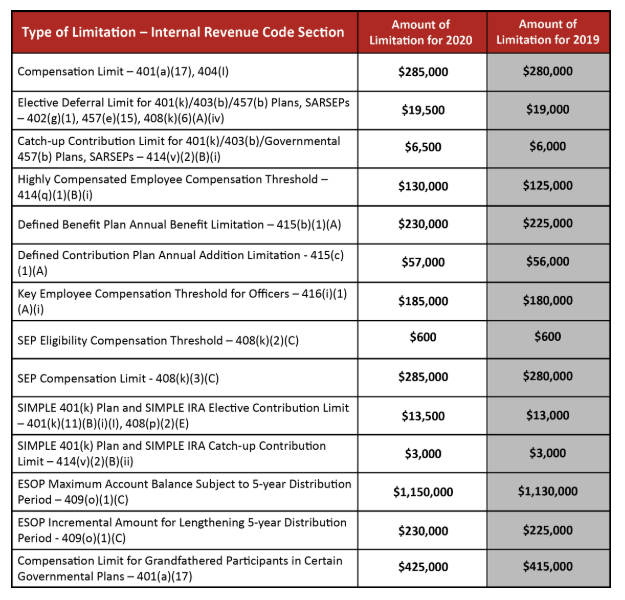

Simple ira 2021 contribution limit irs catch up. The threshold for determining. The catch up contribution limit for simple ira plans is 3 000 in 2015 2021. 403 b plan catch up amounts employees with at least 15 years of service may be eligible to make additional contributions to a 403 b plan in addition to the regular catch up for.

Ira limit 6 000. The catch up contribution limit which is not subject to inflation adjustments remains at 1 000. Another differentiating factor of roth iras is that they.

The basic limitation on the annual benefits under a defined benefit plan is 230 000 and will not change for 2021. Simple ira 13 500. The simple catch up limit also remains unchanged at 3 000 for 2021.

For 2021 roth ira contributions are capped at 6 000 with an additional 1 000 allowed for catch up contributions for those 50 and older. Sep ira 57 000. Employer matching contributions the employer is generally required to match each employee s salary reduction contributions on a dollar for dollar basis up to 3 of the employee s compensation.

2020 ira contribution limits. Simple catch up 3 000. Remember that 2021 ira contributions can be made until april 15 2022 deductible ira phase outs.

For defined benefit plans. Not much has changed for next year. Salary reduction contributions in a simple ira plan are not treated as catch up contributions until they exceed 13 500 in 2020 and 2021 13 000 in 2015 2019.

:max_bytes(150000):strip_icc()/simple_ira_-5bfc2f0c46e0fb00511a52d9.jpg)

:max_bytes(150000):strip_icc()/GettyImages-137513511-572b9ffb5f9b58c34c6a8244.jpg)