Roth Ira Contribution Limits For 2021

6 000 if you re younger than age 50.

Roth ira contribution limits for 2021. The maximum annual contribution to roth ira s is generally 5 000 for savers under the age of 50 and 6 000 for savers over 50. For 2021 2020 and 2019 the total contributions you make each year to all of your traditional iras and roth iras can t be more than. If less your taxable compensation for the year.

If you re under age 50 you can contribute up to 6 000 to an ira in 2021. For 2021 the most you can contribute to your roth and traditional iras is a total of. These are the limits for 2021.

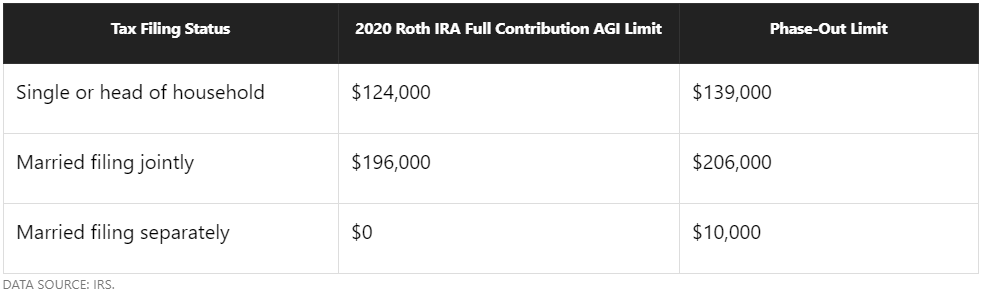

The limit on annual contributions to an individual retirement account pretax or roth or a combination remains at 6 000 for 2021. The limits for a roth ira contribution. The ability to make roth ira contributions is phased out for workers who earn more than 125 000 as an individual and 198 000 as a married couple in 2021.

Married filing separately and you lived with your spouse at any time during the year. So contributions to a roth ira for 2021 can be made through the deadline on april 15 2022 for filing income tax returns. Obtaining an extension of time to file a tax return does not give you.

7 000 if you re aged 50 or older. Married filing jointly or qualifying widow er 198 000. 2021 ira contribution limits.

If your magi is more than. If you re 50 or older you can contribute an extra 1 000 meaning your limit is 7 000. The amount you can contribute is reduced if your magi is between 125 000 and 140 000.