Roth Ira Contribution Limits 2021 Married Filing Jointly

Donna smitherman november 4 2020.

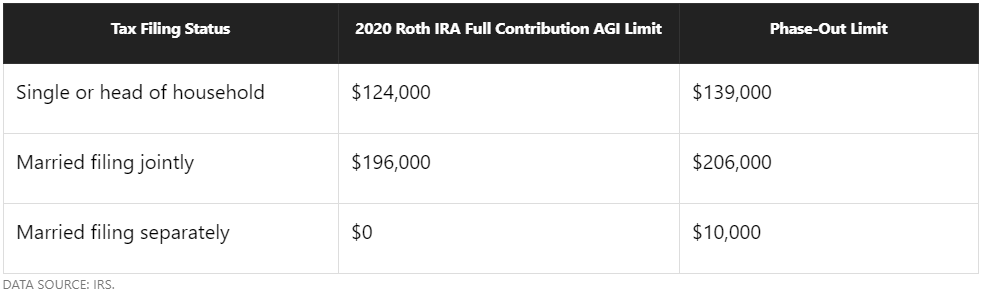

Roth ira contribution limits 2021 married filing jointly. The annual roth ira contribution limit in 2020 and 2021 is 6 000 for adults under 50 and 7 000 for adults 50 and older. Eligibility to make a roth contribution. Note that high earners can still get funds into a roth by utilizing the backdoor roth ira strategy.

125 000 to 140 000 single taxpayers and heads of household. 6 000 7 000 if you re age 50 or older. Filing status modified agi contribution limit.

2020 or 140 000 2021 married filing jointly or qualifying widow. 0 to 10 000 married filing separately. 2021 roth ira income limits.

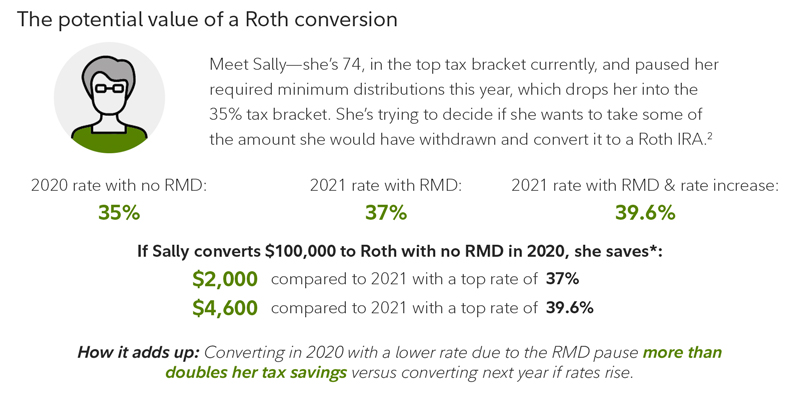

Divide the result in 2 by 15 000 10 000 if filing a joint return qualifying widow er or married filing a separate return and you lived with your spouse at any time during the year. Bad news on ira and 401 k contribution limits for 2021. The 2021 roth ira income limit is up 1 000 for single filers and 2 000 for married filers filing jointly.

198 000 to 208 000 married filing jointly. It s an individual retirement account that means you open and fund it not your employer. The amount you can contribute is reduced if your magi is between 125 000 and 140 000.

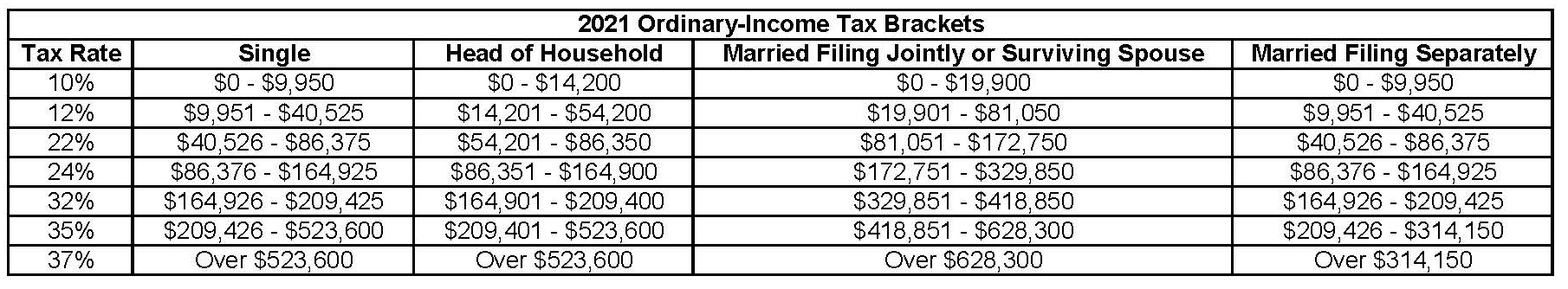

Or more than 44 000 and you re married filing jointly up to 85 of your social security benefits may be taxable. The 2021 roth ira limits every retirement saver needs to know about. If you are married and filing separately single or filing as a head of household you can contribute to a roth ira in tax year 2021 up to the limit for your age if your modified adjusted gross income magi is less than 125 000.