Ohio Income Tax Brackets 2021

The bill also imposes sales tax for out of state sellers and marketplace facilitators.

Ohio income tax brackets 2021. 2018 federal income tax brackets. Projected 2021 tax rate bracket income ranges. Ohio has five marginal tax brackets ranging from 2 85 the lowest ohio tax bracket to 4 8 the highest ohio tax bracket.

For unmarried individuals the prices will get expired in 2025 unless congress decides on extending it. As a result the interaction between act 9 and act. 24 172 751 to 329 850.

The ohio state state tax calculator is updated to include the latest federal tax rates for 2015 16 tax year as published by the irs. 182 91 2 476 of excess over 15 800. The ohio legislature passed hb 166 the fy 2020 2021 biennial budget and with it significant tax reform affecting both businesses and individuals.

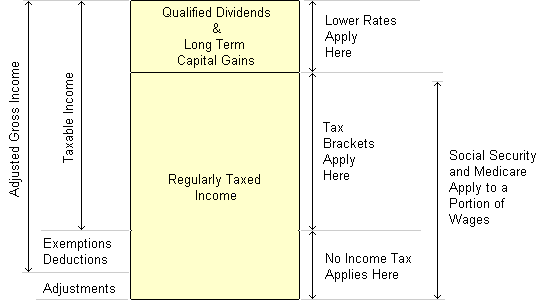

Ohio state personal income tax rates and thresholds in 2021. The bottom rate is 10 while the top rate has fallen from 39 6 to 37 from 2017 federal income tax bracket system. The reform is highlighted by an opportunity zone credit and a 4 individual income tax rate reduction.

37 applies to individual taxpayers with income over 523 600 628 300 for married filing. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in ohio for single filers and couples filing jointly. 10 0 to 19 900.

The ohio state state tax calculator is updated to include the latest state tax rates for 2020 2021 tax year and will be update to the 2021 2022 state tax tables once fully published as published by the various states. 314 14 2 969 of excess over 21 100. 32 329 851 to 418 850.