Estimated 2021 Tax Brackets

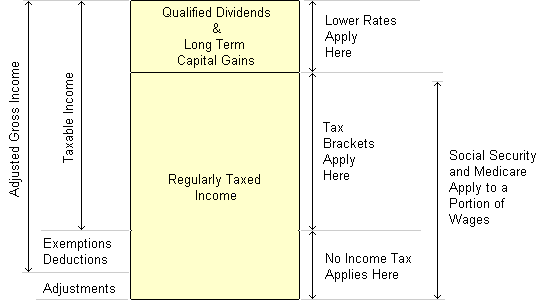

The 15 rate applies to amounts between the two thresholds.

Estimated 2021 tax brackets. There are seven federal tax brackets for the 2020 tax year. In 2021 this means that a single person always gets at least 12 400 as a deduction and a married couple filing jointly always gets at least 25 100 as a deduction. For tax year 2021 the 20 rate applies to amounts above 13 250.

From 2020 to 2021 most inflation adjusted amounts in the tax code including the threshold dollar amounts for tax rate brackets are projected to rise by about 1. The other rates are. Tax code amounts that are.

The federal income tax brackets are updated by the internal revenue service every year. The irs always gives you the standard deduction if you don t have many actual deductions you can verify. As with income tax rates capital gains rates will not change for 2021 but the brackets for the rates will change.

How to get help with your taxes while social distancing. Capital gains rates will not change for 2021 but the brackets for the rates will change. When you use our tax refund estimator we ll ask you questions about these details to let you better calculate your estimated taxes.

Alternative minimum tax phaseout in 2021 the exemption will start phasing out at 523 600 in amti for single filers and 1 047 200 for married taxpayers filing jointly 2021 earned income tax credit. The 0 rate applies to amounts up to 2 700. Understanding tax brackets tax rates your tax bracket is determined by your taxable income and filing status.

10 12 22 24 32 35 and 37. 35 for incomes over 209 425 418 850 for married couples filing jointly. Your bracket depends on your taxable income and filing status.