California State Income Tax Brackets 2021

California also has a considerably high sales tax which ranges from 7 25 to 9 50.

California state income tax brackets 2021. The california state state tax calculator is updated to include the latest state tax rates for 2020 2021 tax year and will be update to the 2021 2022 state tax tables once fully published as published by the various states. The state s seven individual income tax brackets were consolidated into five with the first two brackets eliminated and each of the remaining marginal rates was reduced by 4 percent. Projected 2021 tax rate bracket income ranges.

The tax on gasoline on the other hand is 62 05 cents per gallon and 87 21 cents per gallon of diesel. Indexing of the brackets was frozen at 2018 levels for tax years 2019 and 2020 but is set to resume in 2021. 22 81 051 to 172 750.

What are the california tax rates. California state personal income tax rates and thresholds in 2021. For 2021 the maximum zero rate amount on adjusted net capital gains for married persons will be 80 800 for joint returns and 40 400 for married individuals separate returns.

572 980 01 and above. California income tax rate 2020 2021. There are nine california tax rates and they are based on a taxpayer s adjusted gross income.

State tax is levied by california on your income each year. California income taxes are drawn from your paycheck as a percentage of money that you pay to the state government based on the income you earn. In california different tax brackets are applicable to different filing types.

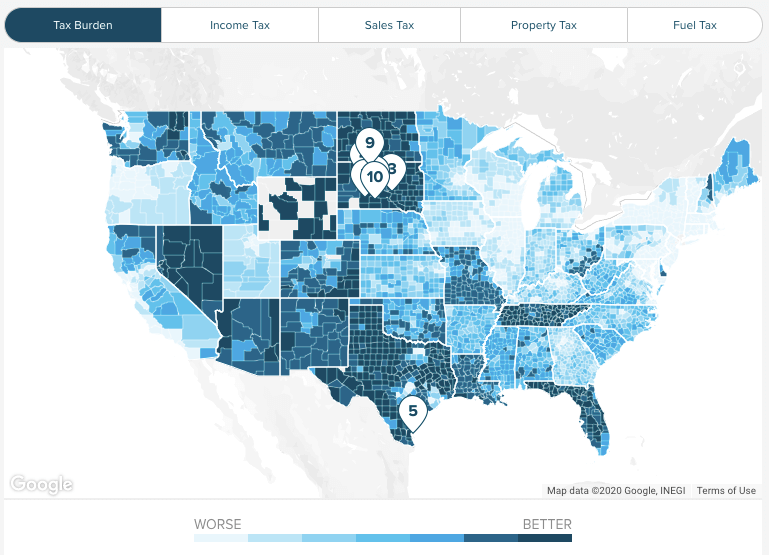

The tax rates in california are between 1 to 13 3 while the average tax burden is 9 47 of personal income. California state income tax rate table for the 2020 2021 filing season has nine income tax brackets with ca tax rates of 1 2 4 6 8 9 3 10 3 11 3 and 12 3 for single married filing jointly married filing separately and head of household statuses. 54 100 for a head.