Arizona Income Tax Brackets 2021

152 668 01 and above.

Arizona income tax brackets 2021. The arizona state state tax calculator is updated to include the latest state tax rates for 2020 2021 tax year and will be update to the 2021 2022 state tax tables once fully published as published by the various states. Match the federal standard deduction amount 12 200 single married filing separate 18 350 head of household 24 400 married filing joint. 2021 federal income tax brackets and rates for single filers married couples filing jointly and heads of households.

Arizona tax rate look up resource. Arizona has four marginal tax brackets ranging from 2 59 the lowest arizona tax bracket to 4 5 the highest arizona tax bracket. Each marginal rate only applies to earnings within the applicable marginal tax bracket.

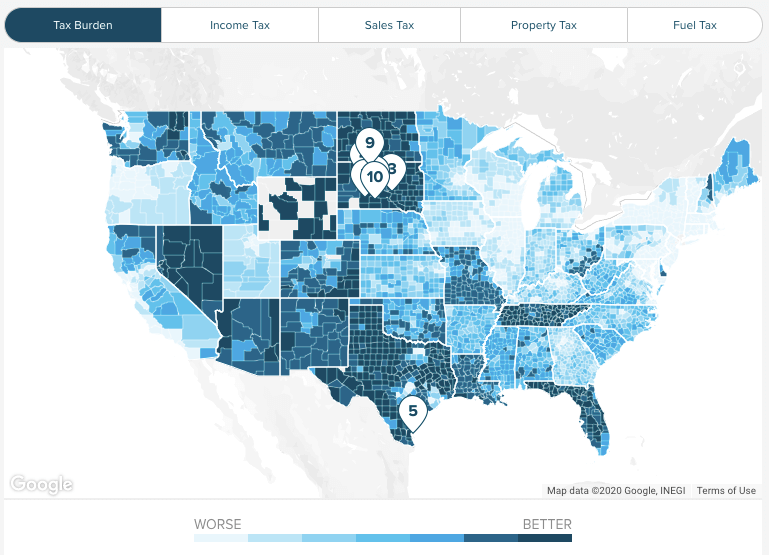

In arizona different tax brackets are applicable to different filing types. Remove arizona personal and dependent exemption amounts. Use the physical address or the zip code or if it is unknown the map locator link can be used to find the location.

Arizona s maximum marginal income tax rate is the 1st highest in the united states ranking directly below arizona s. Beginning in 2020 arizona individual income tax returns for tax year 2019 will include the following adjustments. Rate for unmarried individuals for married individuals filing joint returns for heads of households.

In a recent corner post i discussed arizona s proposition 208 which would introduce a new fifth income tax bracket raising the top rate from 4 5 percent to 8 percent. As an editorial in. Arizona collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Like the federal income tax arizona s income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers. The estimated 1 billion in annual revenue raised. In arizona voters approved a 3 5 tax surcharge on high income taxpayers on top of the current top rate of 4 5 bringing its new top rate to 8.