2021 Wisconsin Income Tax Brackets

Dollar amounts represent taxable income earned in 2020.

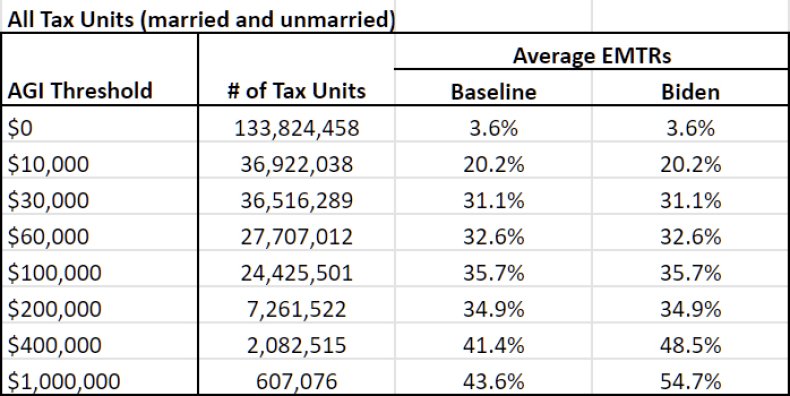

2021 wisconsin income tax brackets. In tax year 2020 for example a single person with taxable income up to 9 875 paid 10 percent while in 2021 that income bracket rises to 9 950. Deduct the amount of tax paid from the tax calculation to provide an example of your 2021 22 tax refund. Wisconsin s maximum marginal income tax rate is the 1st highest in the united states ranking directly below.

Wisconsin income tax rate 2020 2021. Wisconsin state income tax rate table for the 2020 2021 filing season has four income tax brackets with wi tax rates of 3 54 4 65 6 27 and 7 65 for single married filing jointly married filing separately and head of household statuses. Over but not over 2020 tax is of the amount over.

Act 10 further specifies that for tax year 2020 the amount of actual wayfair related sales tax revenue collected between october 1 2019 and september 30 2020 will be used to determine the first two marginal rates for 2020 and that the 2020 rates will apply for tax years 2021 and beyond. Wisconsin collects a state income tax at a maximum marginal tax rate of spread across tax brackets. 32 9 cents per gallon of regular gasoline and diesel.

As a result the interaction between act 9 and act. In wisconsin different tax brackets are applicable to different filing types. Each marginal rate only applies to earnings within the applicable marginal tax bracket.

320 250 01 and above. Wisconsin state personal income tax rates and thresholds in 2021. Below are the tax rates for the 2021 filing season for three common filing statuses.

How tax brackets work in general there are seven tax. The wisconsin state tax calculator is updated to include. Wisconsin has four marginal tax brackets ranging from 4 the lowest wisconsin tax bracket to 7 65 the highest wisconsin tax bracket.