2021 Va Tax Brackets

Virginia state income tax rate table for the 2020 2021 filing season has four income tax brackets with va tax rates of 2 3 5 and 5 75 for single married filing jointly married filing separately and head of household statuses.

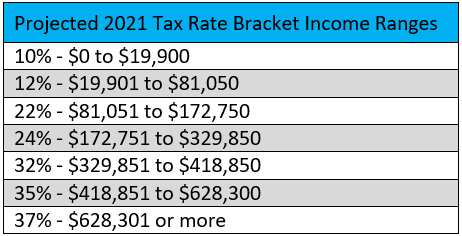

2021 va tax brackets. Dallas nexstar the internal revenue service has released 2021 tax brackets including inflation adjustments for the next year. 10 12 22 24 32 35 and 37 there is also a zero rate. Tax brackets generally change every year and the brackets for 2020 income taxes those filed by april 2021 have been released.

Irs 10 0 to 9 875 0 to 14 100. Tax brackets for income earned in 2021 37 for incomes over 523 600 628 300 for married couples filing jointly 35 for incomes over 209 425 418 850 for married couples filing jointly. The irs also boosted the standard deduction for a single.

2020 tax brackets for taxes due april 15 2021 tax rate single head of household married filing jointly or qualifying widow married filing separately source. Tax brackets and tax rates there are still seven 7 tax rates in 2021. Here s how those break out by filing status.

Virginia has four marginal tax brackets ranging from 2 the lowest virginia tax bracket to 5 75 the highest virginia tax bracket. 2021 federal tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. 120 5 of excess over 5 000.

720 5 75 of excess over 17 000. Waived rmds the coronavirus aid relief and economic security act of 2020. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household.

60 3 of excess over 3 000.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)