2021 Tax Table Philippines

These are the numbers for the tax year 2021 beginning january 1 2021.

2021 tax table philippines. The updated sss contribution table starting january 2021 for employees and employers voluntary self employed ofw and kasambahay or household workers to have at least a rough idea on how much contributions are. In this way they ll be able to understand if. They are not the numbers and tables that you ll use to prepare your 202o tax returns in 2021 you ll find them here.

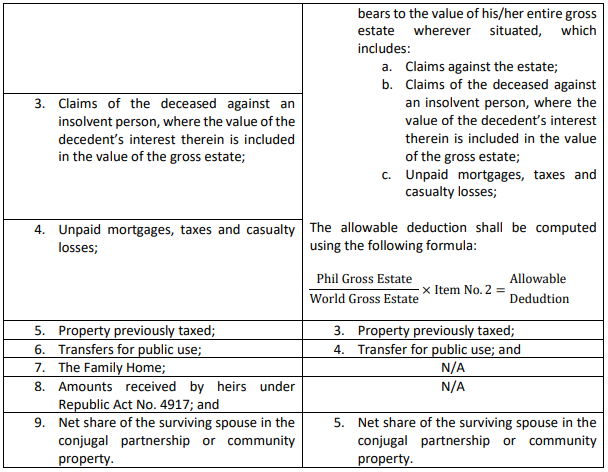

The estate tax return bir form 1801 shall be filed in triplicate by. Corporate tax rate in philippines averaged 31 63 percent from 1997 until 2020 reaching an all time high of 35 percent in 1997 and a record low of 30 percent in 2009. The tax caculator philipines 2020 is using the lastest bir income tax table as well as sss philhealth and pag ibig monthy contribution tables for the computation.

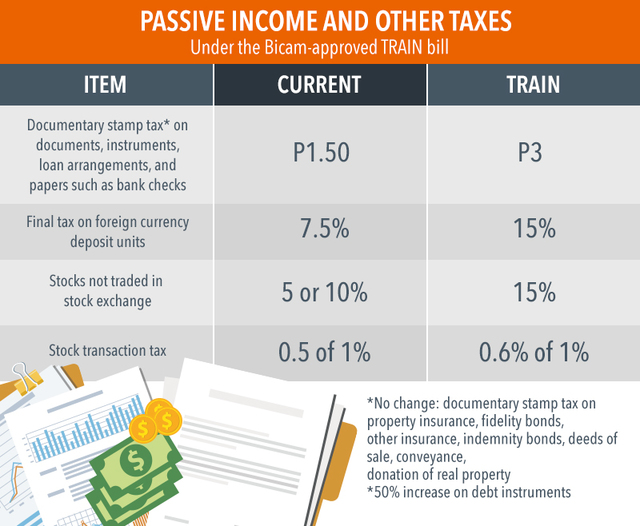

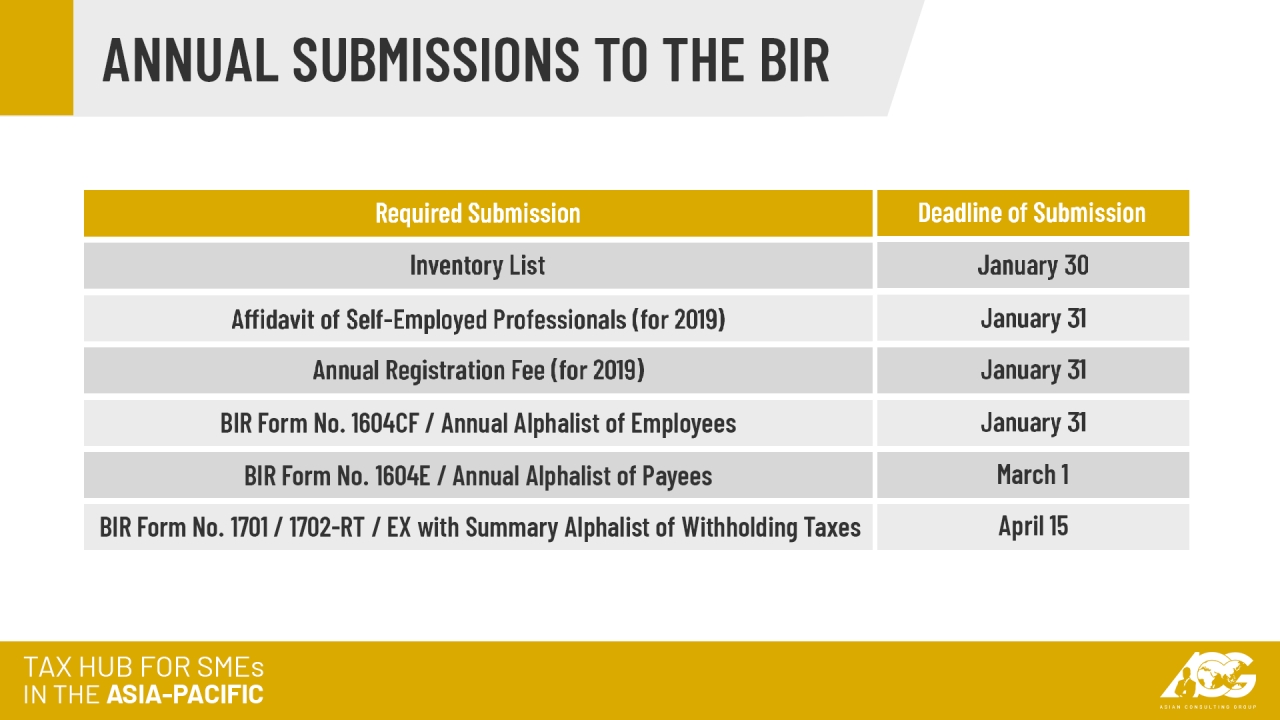

This tax calendar has been prepared by the tax client accounting services cas group of isla lipana co the philippine member firm of the pwc network based on relevant laws rules and regulations issued as of 30 november 2019 by various government. This page provides philippines corporate tax rate actual values historical data forecast chart statistics economic calendar and news. Income tax is a tax on a person s income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the tax code of 1997 tax code as amended less the deductions if.

2021 1 march 2020 28 february 2021 weekly tax deduction tables fortnightly tax deduction tables monthly tax deduction tables annual tax deduction tables other employment tax deduction tables no changes from last year. This chapter examines the tax system of the philippines focusing primarily on the tax implications of bayanihan 1 and 2 introduced during 2020 in an effort to mitigate the impact of the covid 19 pandemic as well as transfer pricing the arm s length principle and. The corporate tax rate in philippines stands at 30 percent.

Although economic activity slowed during the 2020 covid 19 pandemic period stimulus measures imminent public sector policies and a larger budget are expected to create jobs generate growth and help kick start the country s recovery during 2021. The philippines is one of the world s fastest growing nations.