2021 Tax Rate Malaysia

Relocation incentives for selected services sector including an income tax rate of 0 for new.

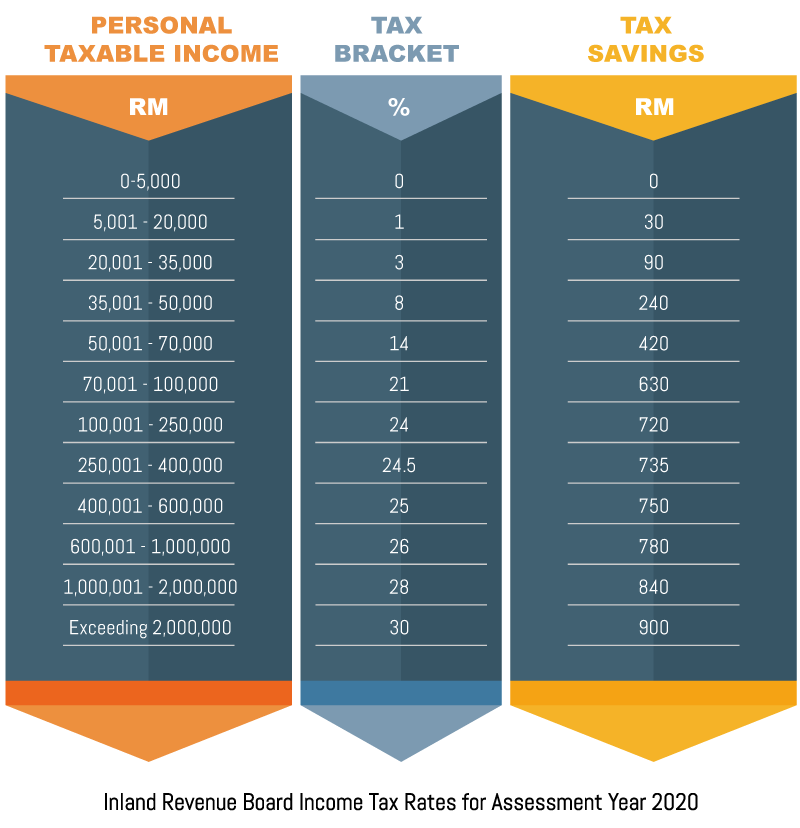

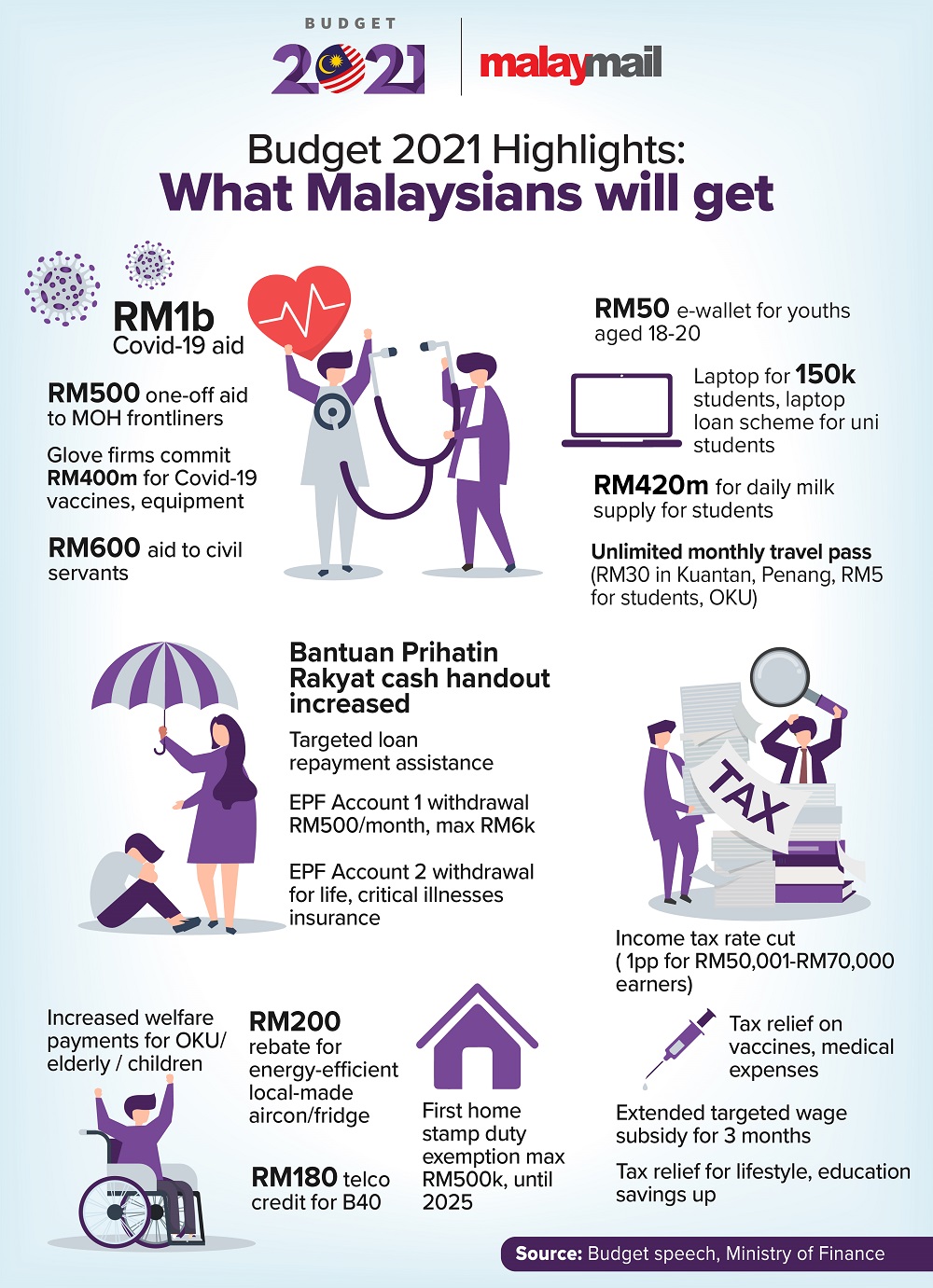

2021 tax rate malaysia. Tax measures proposed in the 2021 budget include. For those earning rm50 000 to rm70 000 a year the income tax rates 2021 personal tax rates 2021 lower by 1 point. Corporate tax rate in malaysia is expected to reach 24 00 percent by the end of 2020 according to trading economics global macro models and analysts expectations.

Personal income tax is reduced by one percentage point for those earning rm50 001 rm70 000. Chargeable income calculations rm rate tax rm 0 5 000 on the first 2 500 0 0 5 001 20 000 on the first 5 000 next 15 000 1 0 150 20 001 35 000 on the first 20 000 next 15 000 5 150 750 35 001 50 000 on the first 35 000 next 15 000 10 900. In a statement today the royal malaysian customs department said the eight per cent export duty rate was set after the cpo market price reached rm3 450 per tonne and above.

Getty the internal revenue service irs has announced the annual inflation adjustments for the tax year 2021 including tax rate schedules tax tables and cost of living adjustments. The rate would be effective on jan 1 until jan 31 2021 marking the end of the zero export tax enjoyed from june to december 2020 which was aimed at raising the value of malaysian palm exports. In the long term the malaysia corporate tax rate is projected to trend around 24 00 percent in 2021 according to our econometric models.

With the negative impact of the pandemic on the malaysian market the government has consider providing temporary tax breaks to individual taxpayers who have suffered salary reductions or job losses. Kuala lumpur dec 22 malaysia has set the export tax for crude palm oil cpo at eight per cent for january 2021. Employees minimum epf contribution is reduced to nine per cent starting january 2021.