2021 Tax Brackets Virginia

Dollar amounts represent taxable income earned in 2020.

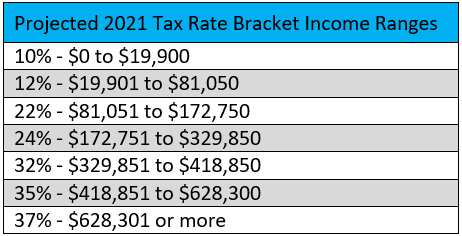

2021 tax brackets virginia. 10 applies to individual taxpayers with income under 9 950 19 900 for. How tax brackets work in general there are seven tax. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in virginia for single filers and couples filing jointly.

Virginia state income tax rate table for the 2020 2021 filing season has four income tax brackets with va tax rates of 2 3 5 and 5 75 for single married filing jointly married filing separately and head of household statuses. 60 3 of excess over 3 000. Virginia has four marginal tax brackets ranging from 2 the lowest virginia tax bracket to 5 75 the highest virginia tax bracket.

Tax brackets generally change every year and the brackets for 2020 income taxes those filed by april 2021 have been released. Federal income tax brackets were last. The virginia income tax has four tax brackets with a maximum marginal income tax of 5 75 as of 2020.

Detailed virginia state income tax rates and brackets are available on. 720 5 75 of excess over 17 000. Social security announces 2021 benefit increase here s how the 7 tax brackets will break down according to cnbc.

2021 virginia tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Here are the 2020 income tax brackets for federal taxes. Below are the tax rates for the 2021 filing season for three common filing statuses.

This means that these brackets applied to all income earned in 2020 and the tax return that uses these tax rates was due in april 2021. As with income tax rates capital gains rates will not change for 2021 but the brackets for the rates will change.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)