2021 Tax Brackets Us

But a win by democrat presidential candidate joe biden in november will change these brackets.

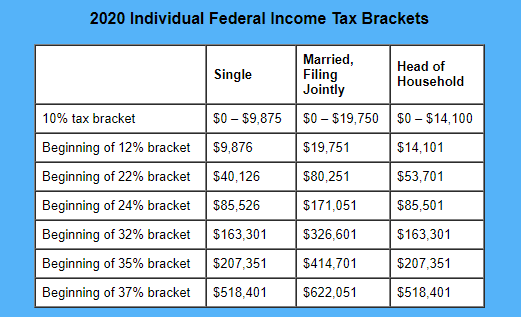

2021 tax brackets us. Dollar amounts represent taxable income earned in 2020. For 2021 the tax bracket thresholds were increased by approximately 1 over 2020 levels. American taxpayers have been categorized into one of seven brackets depending on income.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household. 35 for incomes over 209 425 418 850 for married couples filing jointly. The upper limits of these brackets have changed slightly for inflation meaning that clients have a little more room.

The standard deduction for 2021 was also increased. For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523 600 628 300 for married couples filing jointly. 10 12 22 24 32 35 and 37 there is also a zero rate.

Tax brackets the seven tax brackets ranging from 10 to 37 have not changed. 2021 federal income tax brackets and rates in 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1. Here s how those break out by filing status.

Irs 10 0 to 9 950 0 to 14 200. Tax brackets and tax rates there are still seven 7 tax rates in 2021. To clarify the 2021 tax brackets are the rates that will determine your income tax in 2021 which is the.

2021 tax brackets for taxes due april 15 2022 tax rate single head of household married filing jointly or qualifying widow married filing separately source. 2021 minnesota tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. How tax brackets work in general there are seven tax.