2021 Tax Brackets Uk

These are the numbers for the tax year 2021 beginning january 1 2021.

2021 tax brackets uk. Dallas nexstar the internal revenue service has released 2021 tax brackets including inflation adjustments for the next year. They are not the numbers and tables that you ll use to prepare your 202o tax returns in 2021 you ll find them here. The irs also boosted the standard deduction for a single taxpayer.

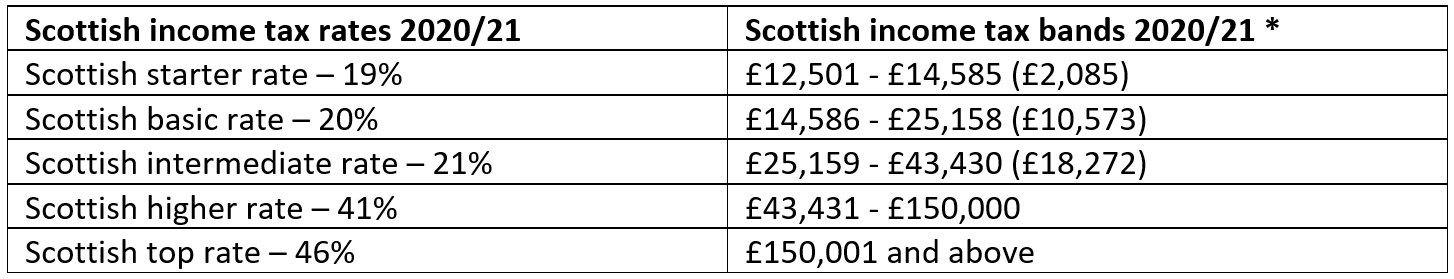

All these are relatively small increases from 2020. Tax rates 2020 2021 year residents the 2021 financial year starts on 1 july 2020 and ends on 30 june 2021. Each year the taxman updates its individual income tax brackets to reflect inflation.

The new tax year in the uk starts on 6 april 2020. Kpe personal exemption amounts as part of the tcja there are no personal exemption. The 2018 budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 july 2018 through to 1 july 2024.

And while the income tax brackets and personal tax allowance won t be changing in 2020 21 chancellor rishi sunak s highly anticipated budget speech on 11 march had good news for both the employed and self employed. The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. 10 12 22 24 32 35 and 37.

Latest business and tax news 20 12 2020 help to save accounts receive christmas bonus payment 17 12 2020 furlough scheme now extended to end of april 2021 10 12 2020 one off wealth tax for people worth over 500 000 view all business and tax. There are seven brackets. 2021 earned income tax credit the maximum earned income tax credit in 2021 for single and joint filers is 543 if the filer has no children table 5.

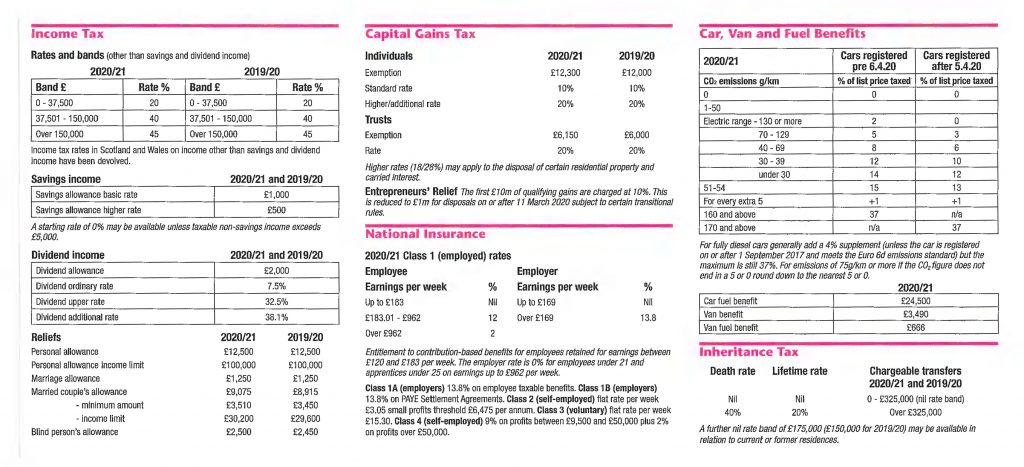

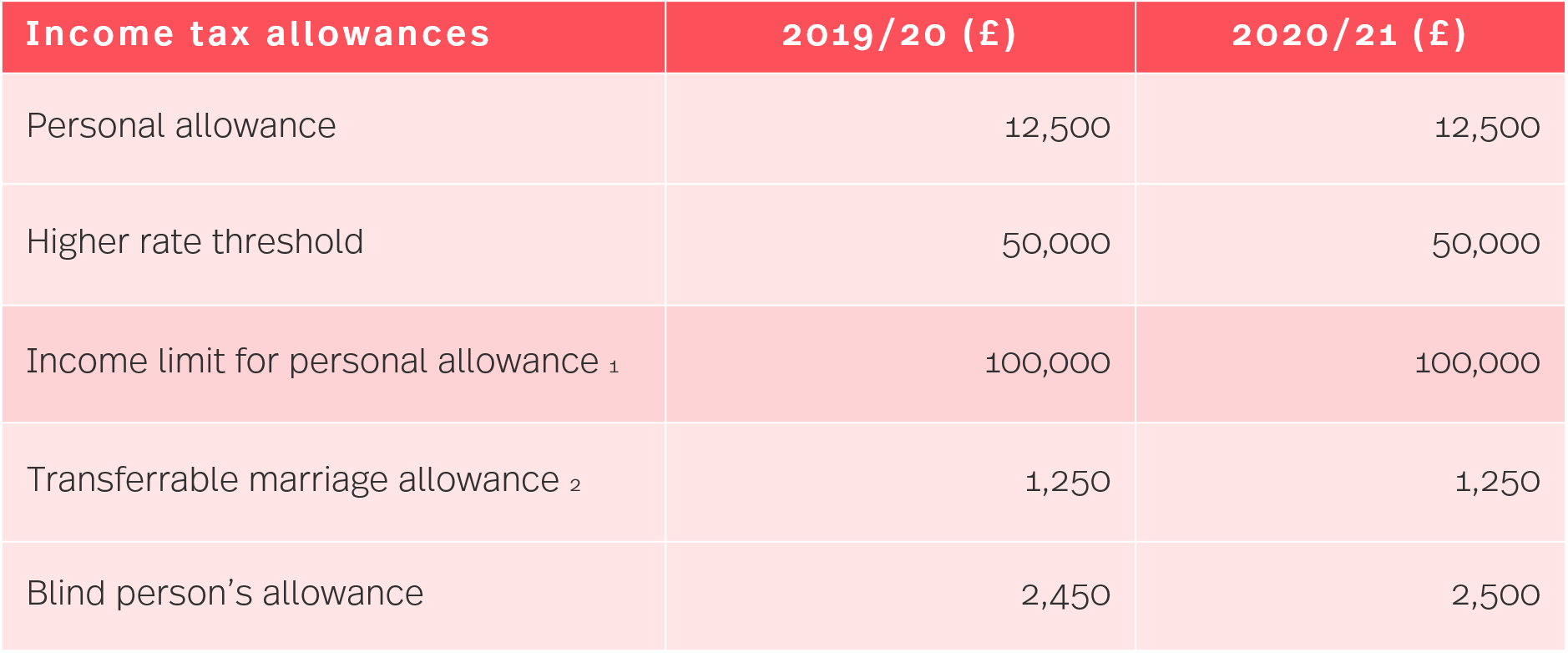

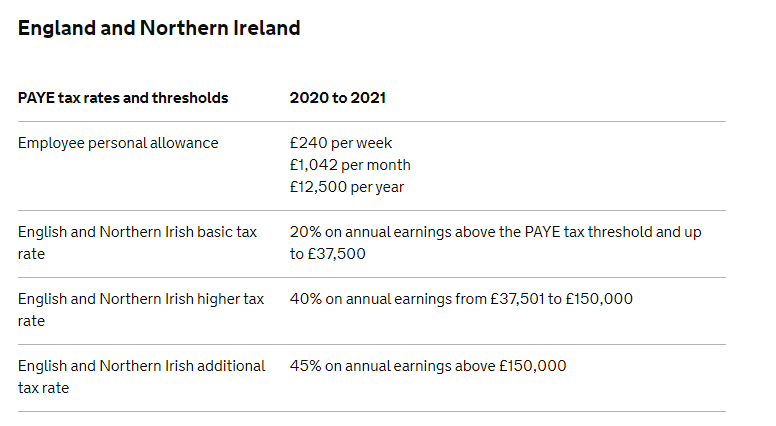

The current tax year is from 6 april 2020 to 5 april 2021. Paye tax rates and thresholds 2020 to 2021 employee personal allowance 240 per week 1 042 per month 12 500 per year english and northern irish basic tax rate 20 on annual earnings above the.