2021 Tax Brackets Single

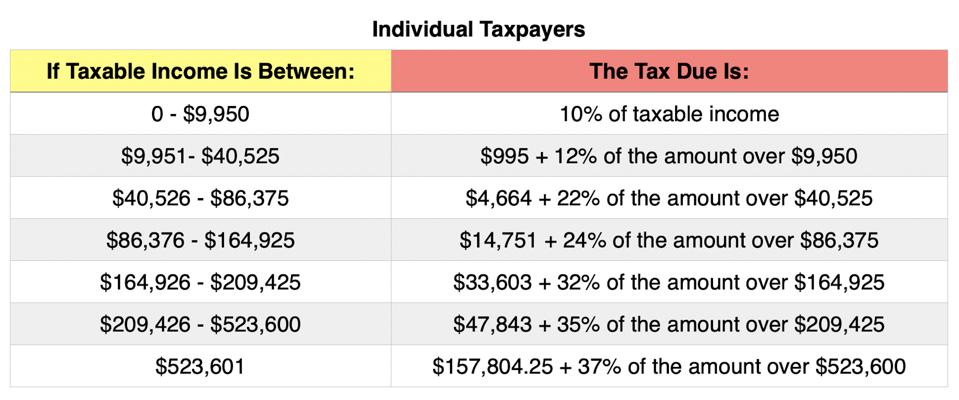

2021 federal income tax brackets and rates in 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.

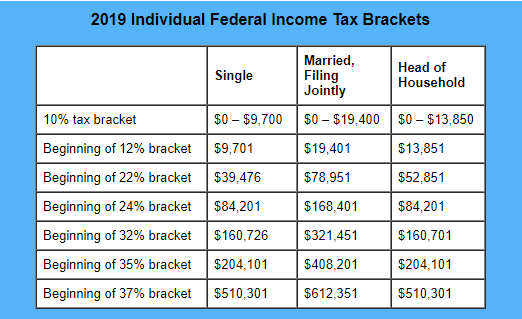

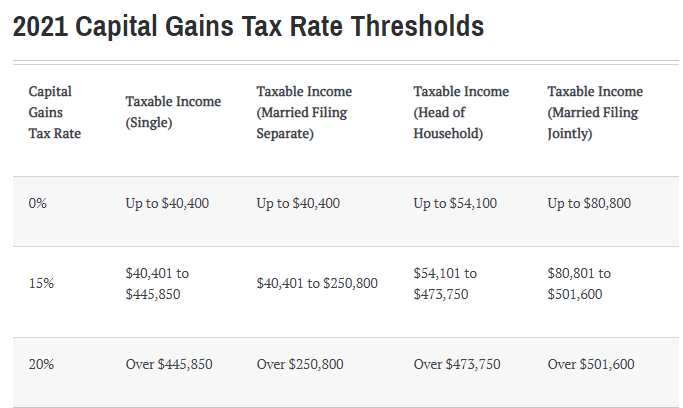

2021 tax brackets single. 10 12 22 24 32 35 and 37 there is also a zero rate. To clarify the 2021 tax brackets are the rates that will determine your income tax in 2021 which is the. For 2020 the income brackets are as follows for folks whose tax filing status is single.

The tax rates haven t changed since 2018. For 2021 they re still set at 10 12 22 24 32 35 and 37. Single or married filing separately.

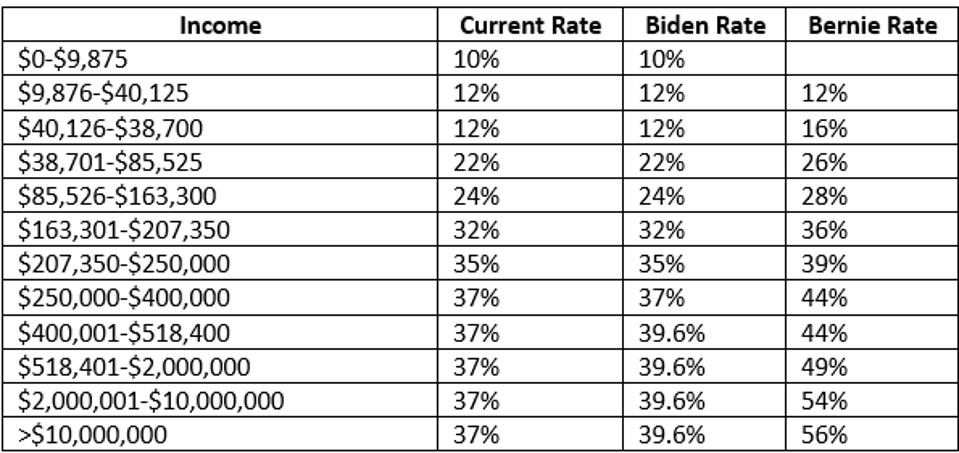

Note that joe biden wants to increase the top rate if he s elected however the tax. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Income tax brackets also tend to rise annually.

The additional standard deduction for people who have reached age 65 or who are blind is 1 350 for each married taxpayer or 1 700 for unmarried taxpayers. Tax brackets and tax rates there are still seven 7 tax rates in 2021. For 2021 the tax bracket thresholds were increased by approximately 1 over 2020 levels.

2020 2021 federal income tax brackets. Here s a look at the 2021 tax brackets and other changes to personal taxes next year. Similarly other brackets for income earned in 2021 have been adjusted upward as well.

The 2021 standard deduction amounts are as follows. In tax year 2020 for example a single person with taxable income up to 9 875 paid 10 percent while in 2021 that income bracket rises to 9 950. Up to 9 950 12.