2021 Tax Brackets Pdf

Resident tax rates 2020 21 taxable income tax on this income 0 18 200 nil 18 201 45 000 19 cents for each 1 over 18 200 45 001 120 000 5 092 plus 32 5 cents for each 1 over 45 000 120 001 180 000 29 467 plus 37 cents for each 1 over.

2021 tax brackets pdf. These are the numbers for the tax year 2021 beginning january 1 2021. Tax rate 2020 2021 employee 7 65 7 65 self employed 15 30 15 30 note. And since the federal income tax brackets for the 2021 tax year are now available you can start thinking about how to handle your 2021 finances in a tax efficient way even though it s still 2020.

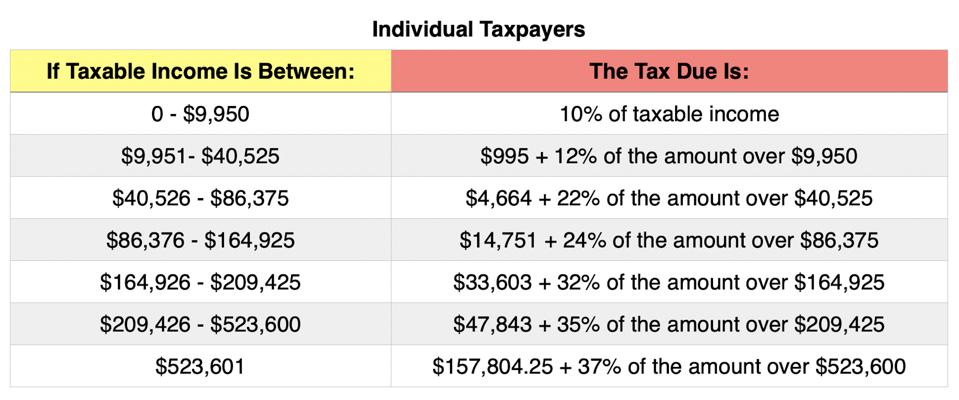

Taxable income tax rate r 0 r 205 900 18 r 205 901 r 321 600 r 37 062 26 of amount above r 205 900 r 321 601 r 445 100 r 67 144 31. 2021 federal income tax brackets for taxes due in april 2022 for individuals married filing jointly married filing separately and head of household are given below. In 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.

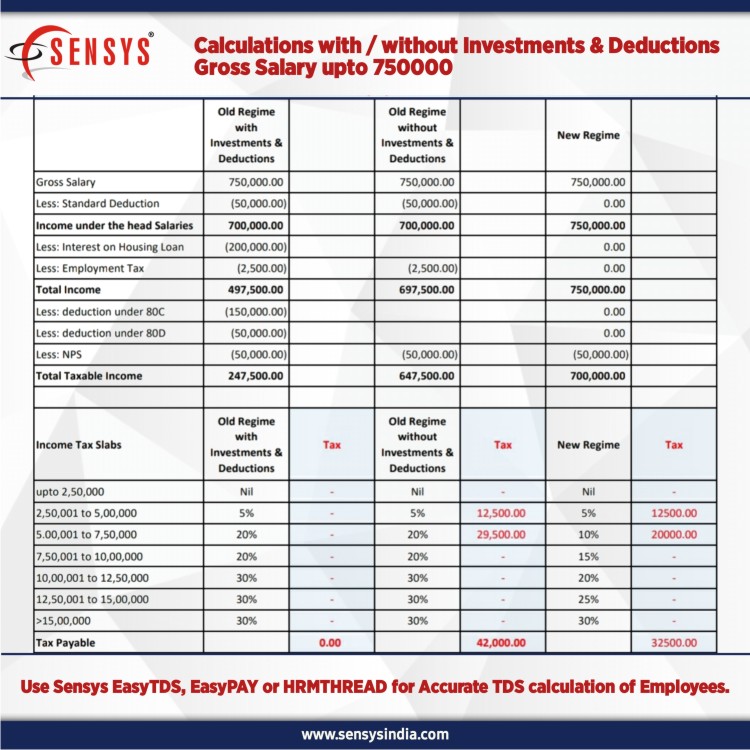

Income tax tables with rebates and car allowance fix cost tables for the 2021 tax year as provided by sars. The social security portion oasdi is 6 20 on earnings up to the applicable earnings. The 7 65 tax rate is the combined rate for social security and medicare.

Ir 2020 245 october 26 2020 washington the internal revenue service today announced the tax year 2021 annual inflation adjustments for more than 60 tax provisions including the tax rate schedules and other tax changes. Keywords bill cass ii963 2021 taxes created date 11 27 2020 12 02 46. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly.

Revenue procedure 2020 45 pdf provides details about these annual adjustments. 2021 tax rates schedules and contribution limits author putnam investments subject provides a detailed look at 2021 tax rates schedules and contribution limits.