2021 Tax Brackets California

Deduct the amount of tax paid from the tax calculation to provide an illustration of your 2020 2021 tax.

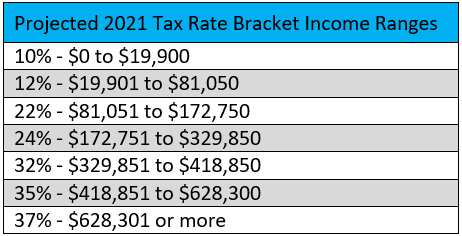

2021 tax brackets california. California also has a considerably high sales tax which ranges from 7 25 to 9 50. The california tax brackets on this page have been updated for tax year 2020 and are the latest brackets available. California state income tax rate table for the 2020 2021 filing season has nine income tax brackets with ca tax rates of 1 2 4 6 8 9 3 10 3 11 3 and 12 3 for single married filing jointly married filing separately and head of household.

They are not the numbers and tables that you ll use to prepare your 202o tax returns in 2021 you ll find them here. Huffpost life via yahoo news 1 year ago following the tax brackets above the first 9 875 of income is taxed at 10 meaning you will pay. The first two brackets eliminated and each of the remaining marginal rates was reduced by 4 percent.

States often adjust their tax brackets on a yearly basis so make sure to check back later for california s updated tax year 2021 tax brackets. Click here for 2020 s tax brackets. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household.

The irs released new tax brackets for 2020. 2020 2021 california state state tax refund calculator calculate your total tax due using the tax calculator update to include the 2020 2021 tax brackets. For 2021 the top tax rate of 37 will apply to individual.

The tax on gasoline on the other hand is 62 05 cents per gallon. 2021 tax brackets rate married joint return single individual head of household married separate return 10 19 900 or less 9950 or less 14 200 or less 9950 or less 12 over 19 900 over. These rates are in effect for 2021 and will affect the returns you file for that year in 2022.

These are the numbers for the tax year 2021 beginning january 1 2021. The tax rates in california are between 1 to 13 3 while the average tax burden is 9 47 of personal income.