2021 Tax Brackets Budget

Tax on this income.

2021 tax brackets budget. Resident tax rates 2020 21 taxable income tax on this income 0 18 200 nil 18 201 45 000 19 cents for each 1 over 18 200 45 001 120 000 5 092 plus 32 5 cents for each 1 over 45 000 120 001 180 000 29 467 plus 37 cents for each 1 over. Rates of tax for individuals. 2021 tax year 1 march 2020 28 february 2021 see the changes from the previous year.

The tax rate will be reduced from 14 to 13 for the year of assessment 2021. 61 200 plus 45c for each 1 over 180 000. Under this law in 2021 those people will get a tax increase of about 365 each.

Taxable income r rates of tax r 1 205 900. 32 5c for each 1. A permanent tax cut will be phased in with a reduction of sek 1 500 158 61 in 2021 sek 1 880 198 79 in 2022 and sek 3 000 317 23 in 2023 per full time worker.

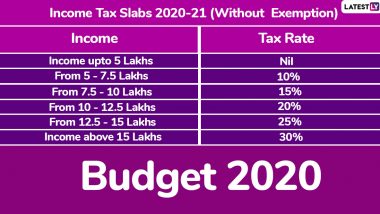

Under the income tax act 1961 the percentage of income payable as tax is based on the amount of. 37 062 26 of taxable income above 205 900. The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year.

The 2018 budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 july 2018 through to 1 july 2024. For the middle income m40 group one piece of good news from budget 2021 could be the reduction in tax rate by one percentage point for the chargeable income band of rm50 001 to rm70 000. The costs of the permanent tax cuts are expected to climb from sek 8 5 billion 898 80 million in 2021 to sek 17 billion 1 80 billion in 2023.

Tax rates 2020 2021 year residents the 2021 financial year starts on 1 july 2020 and ends on 30 june 2021. They are not the numbers and tables that you ll use to prepare your 202o tax returns in 2021 you ll find them here. 0 comments these increases on taxes for low income americans may have been put in place to try to make up for the massive tax breaks given to the extremely wealthy and corporations during the trump administration.