2021 Tax Brackets Bc

Personal tax and rrsp tax savings calculators and tax rate cards.

2021 tax brackets bc. Tax rates marginal personal income tax rates for 2021 and 2020 2021 2020 tax brackets and tax rates canada and provinces territories choose your province or territory below to see the combined federal provincial territorial marginal tax. This means that these brackets applied to all income earned in 2020 and the tax return that uses these tax rates was due in april 2021. The 2018 budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 july 2018 through to 1 july 2024.

The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. Remember settings performance cookies to measure the website s performance and improve your. Provincial or territorial specific non refundable tax credits are also calculated on form 428.

The bc tax brackets and personal tax credit amounts are increased for 2021 by an indexation factor of 1 011. Tax rates 2020 2021 year residents the 2021 financial year starts on 1 july 2020 and ends on 30 june 2021. The indexation factors tax.

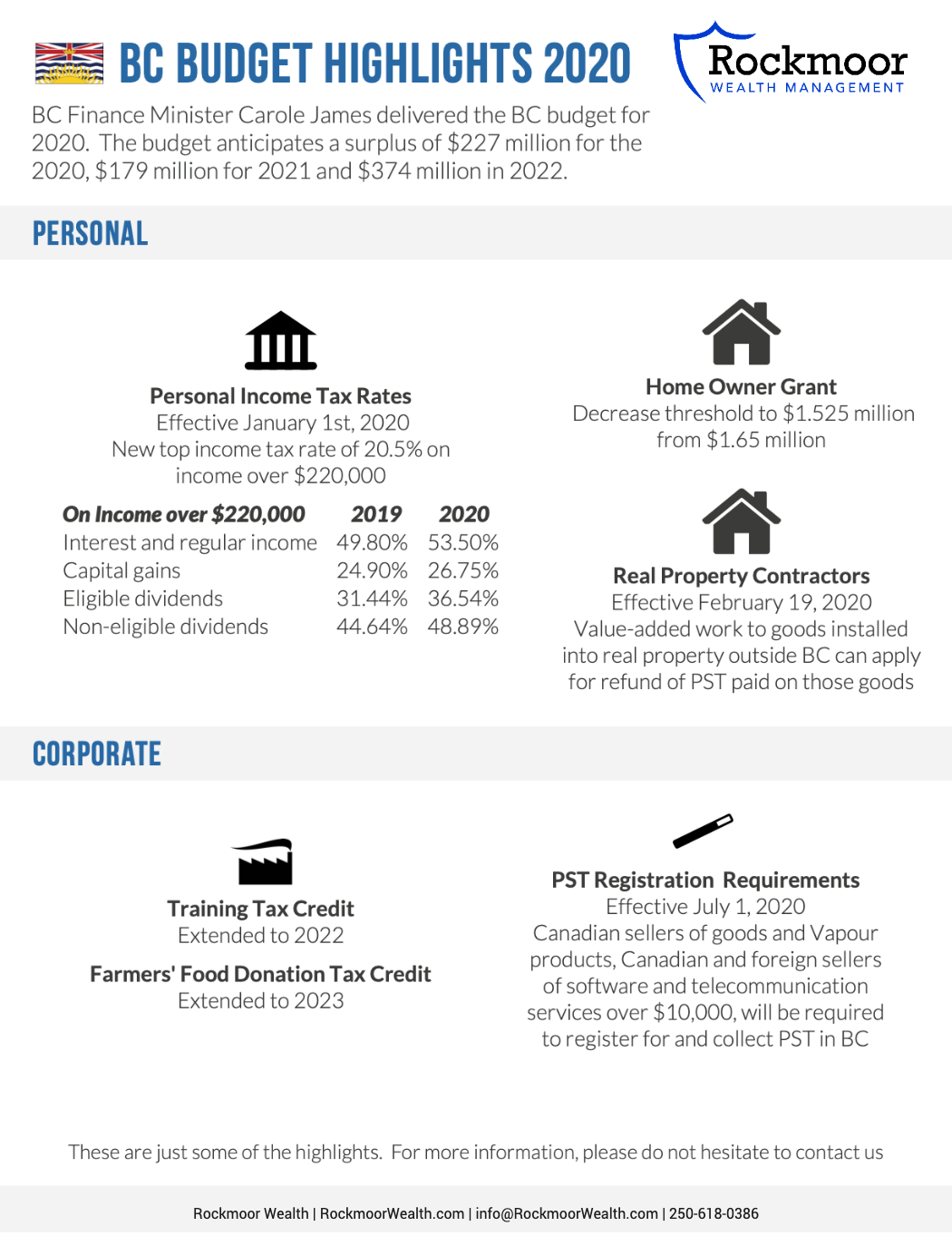

Budget 2020 proposes adding a new tax bracket for income above 220 000 at a rate of 20 5. Resident tax rates 2020 21 taxable income tax on this income 0 18 200 nil 18 201 45 000 19 cents for each 1 over 18 200 45 001 120 000 5 092 plus 32 5 cents for each 1 over 45 000 120 001 180 000 29 467 plus 37 cents for each 1 over. Federal income tax brackets were last.

Provincial and territorial tax rates for 2020 tax for all provinces except quebec and territories is calculated the same way as federal tax. For example if your taxable income is more than 41 725 the first 41 725 of taxable income is taxed at 5 06 the next 41 726 of taxable income. Bc jan 1 2021 set indexation rate for brackets and credits to 1 1 bc jan 1 2020 new personal tax of 20 5 for income over 220 000 bill 4 2020 bc july 1 2020.

Form 428 is used to calculate this provincial or territorial tax. Tax rates are applied on a cumulative basis.