2021 Tax Brackets Arizona

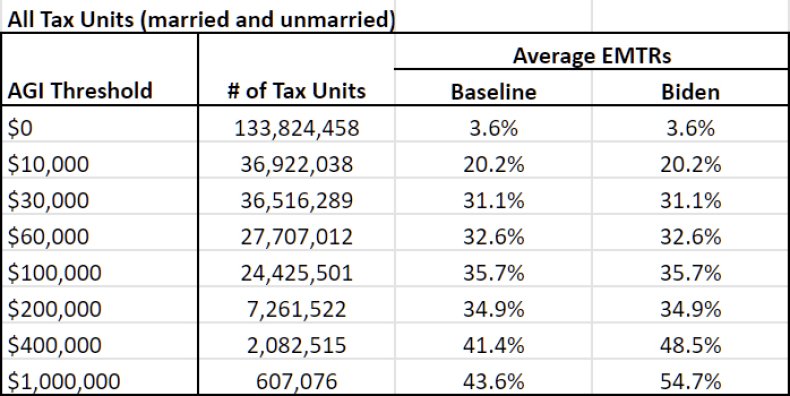

Provide 100 child tax credit per dependent under 17 years of age and 25 for dependents 17 and older.

2021 tax brackets arizona. Though actual tax brackets remained the same 10 12 22 24 32 and 35 income limits for each bracket were increased to account for inflation. For 2021 the top tax rate of 37 will apply to individual taxpayers with income over 523 600 628 300 for married filing jointly. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household.

The credit is phased out for federal adjusted gross income fagi greater than 200 000 single married filing separate and head of household 400 000 married filed joint. Use the physical address or the zip code or if it is unknown the map locator link can be used to find the location. Remove arizona personal and dependent exemption amounts.

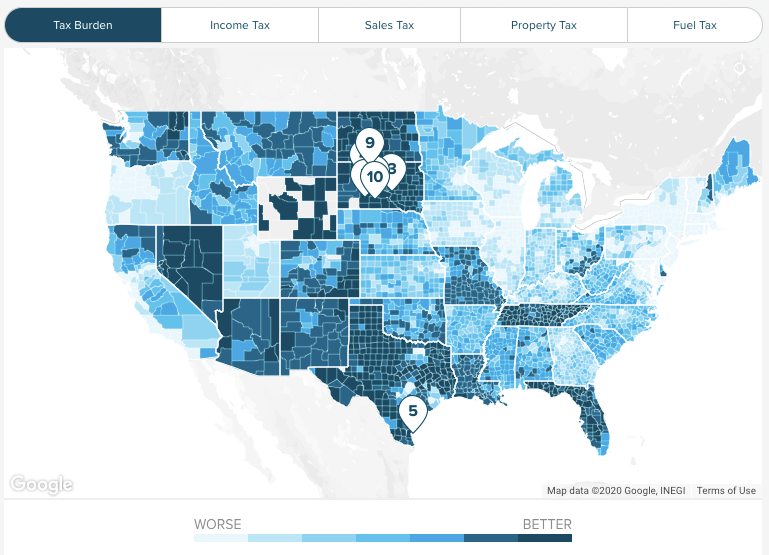

2020 2021 arizona state state tax refund calculator calculate your total tax due using the tax calculator update to include the 2020 2021 tax brackets. 2021 arizona tax tables with 2021 federal income tax rates medicare rate fica and supporting tax and withholdings calculator. Arizona is considered to be a tax advantaged state meaning the arizona tax rates are lower than many other states in the u s.

2021 earned income tax credit. The maximum credit is 3 618 for one child 5 980 for two children and 6 728 for three or more children. This month the irs released updates to the tax code for tax year 2021.

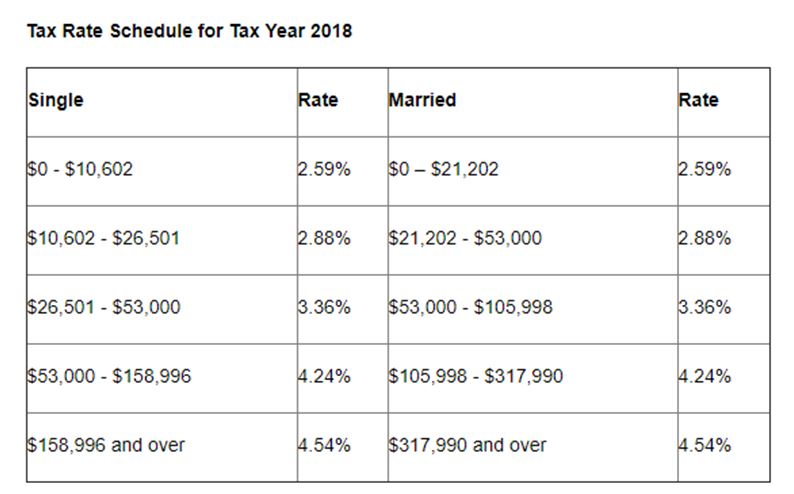

All these are relatively small increases from 2020. Arizona has four marginal tax brackets ranging from 2 59 the lowest arizona tax bracket to 4 5 the highest arizona tax bracket. Arizona state income tax rate table for the 2020 2021 filing season has four income tax brackets with az tax rates of 2 59 3 34 4 17 and 4 50 for single married filing jointly married filing separately and head of household statuses.

Arizona tax rate look up resource this resource can be used to find the transaction privilege tax rates for any location within the state of arizona. The maximum earned income tax credit in 2021 for single and joint filers is 543 if the filer has no children table 5. In arizona different tax brackets are.