2021 Simple Ira Contribution Limits Over 50

Here s the breakdown for the 2021 ira contribution limit changes.

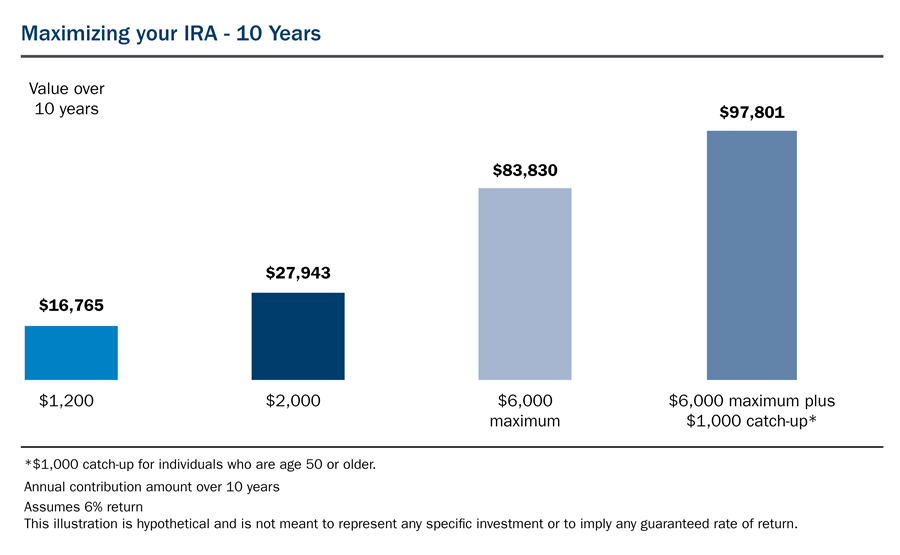

2021 simple ira contribution limits over 50. If you re age 50 or over you can contribute an additional 3 000 in 2015 2021 in catch up contributions. The amount you can contribute to an individual retirement account stays the same for 2021. Ira contribution limits the maximum amount you can contribute to a traditional ira or a roth ira in 2021 is 6 000 or 100 of your earned income if less unchanged from 2020.

The salary reduction contributions under a simple ira plan are elective deferrals that count toward the overall annual limit on elective deferrals an employee may make to this and other plans permitting elective deferrals. The catch up contribution limit for simple ira plans is 3 000 in 2015 2021. Many ira and retirement plan limits are indexed for inflation each year.

6 000 with a 1 000 catch up limit if you re 50 or older. The ira contribution limit for 2021 is 6 000 or your taxable income whichever is lower. Those over 50 can contribute an extra 1 000 to traditional and roth iras in 2021.

Simple ira plan limits employee contributions. Simple ira 13 500. The catch up contribution limit for employees age 50 or older who participate in these plans also holds steady in 2021 at 6 500 for a total contribution limit of 26 000 for employees 50 and.

Not much has changed for next year. Catch up contributions for savers who will be 50 or older by the end of 2021 let them save up to 7 000. Employees age 50 or over can make a catch up contribution of up to 3 000 in 2016 2021 subject to cost of living adjustments for later years.

Simple catch up 3 000. 2020 ira contribution limits. For 2021 the ira contribution limit is 6 000 or 7 000 if you are at least age 50.