2021 Roth Ira Contribution Limits Irs

The additional catch up contribution limit for individuals aged 50 and over is not subject to an annual cost of living adjustment and remains 1 000.

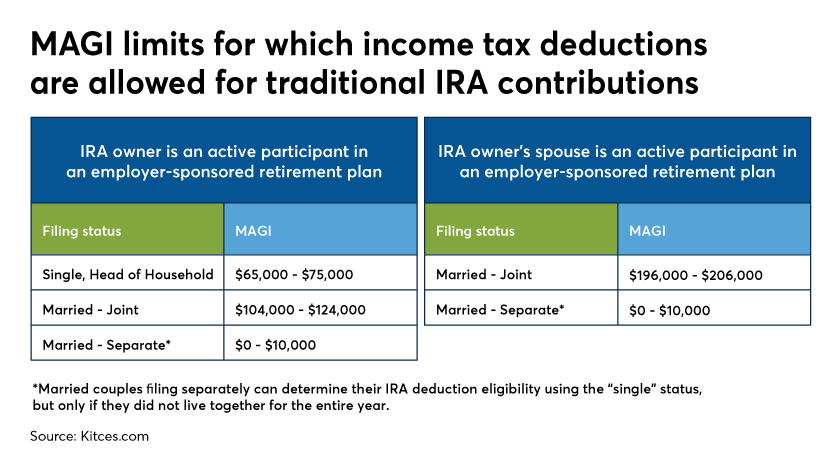

2021 roth ira contribution limits irs. The limit on annual contributions to an ira remains unchanged at 6 000. For 2018 2017 2016 and 2015 the total contributions you make each year. Here are the traditional ira phase out ranges for 2021.

Roth ira income limits are increasing in 2021. The 2021 combined annual contribution limit for roth and traditional iras is 6 000 7 000 if you re age 50 or older unchanged from 2020. If less your taxable compensation for the year.

Up to the limit. Similarly ira contribution limits are the same at 6 000 in 2021 and 7 000 for workers over age 50. 105 000 to 125 000 married couples filing jointly.

198 000 but 208 000. Then you can contribute. This applies when the spouse making the ira contribution is covered by a workplace retirement plan.

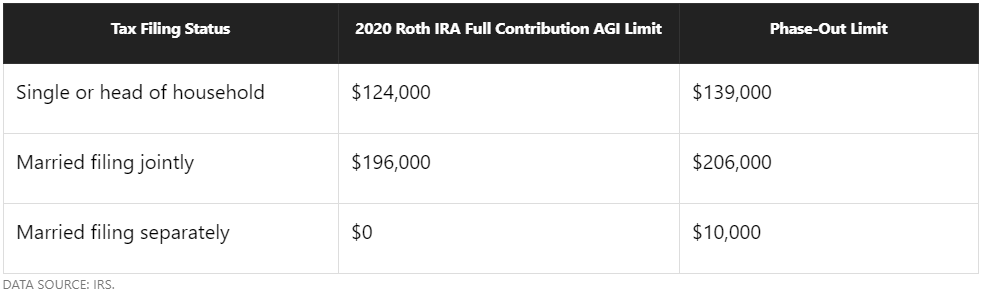

If your magi is more than 140 000. Your roth ira contributions may also be limited based on your filing status and income. Eligibility to make a roth contribution.

The annual contribution limit for 2015 2016 2017 and 2018 is 5 500 or 6 500 if you re age 50 or older. In 2021 the agi phase out range for taxpayers making contributions to a roth ira is 198 000 to 208 000 for married couples filing jointly up from 196 000 to 206 000 in 2020. Retirement topics ira contribution limits.