2021 Roth Ira Contribution Income Limits

Taxpayers can deduct contributions to a traditional ira if they meet certain conditions.

2021 roth ira contribution income limits. Single head of household or married filing separately and you did not live with your spouse at any time during the year 124 000. A reduced amount 206 000. Roth ira income limits are increasing in 2021.

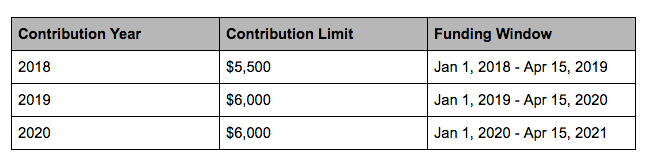

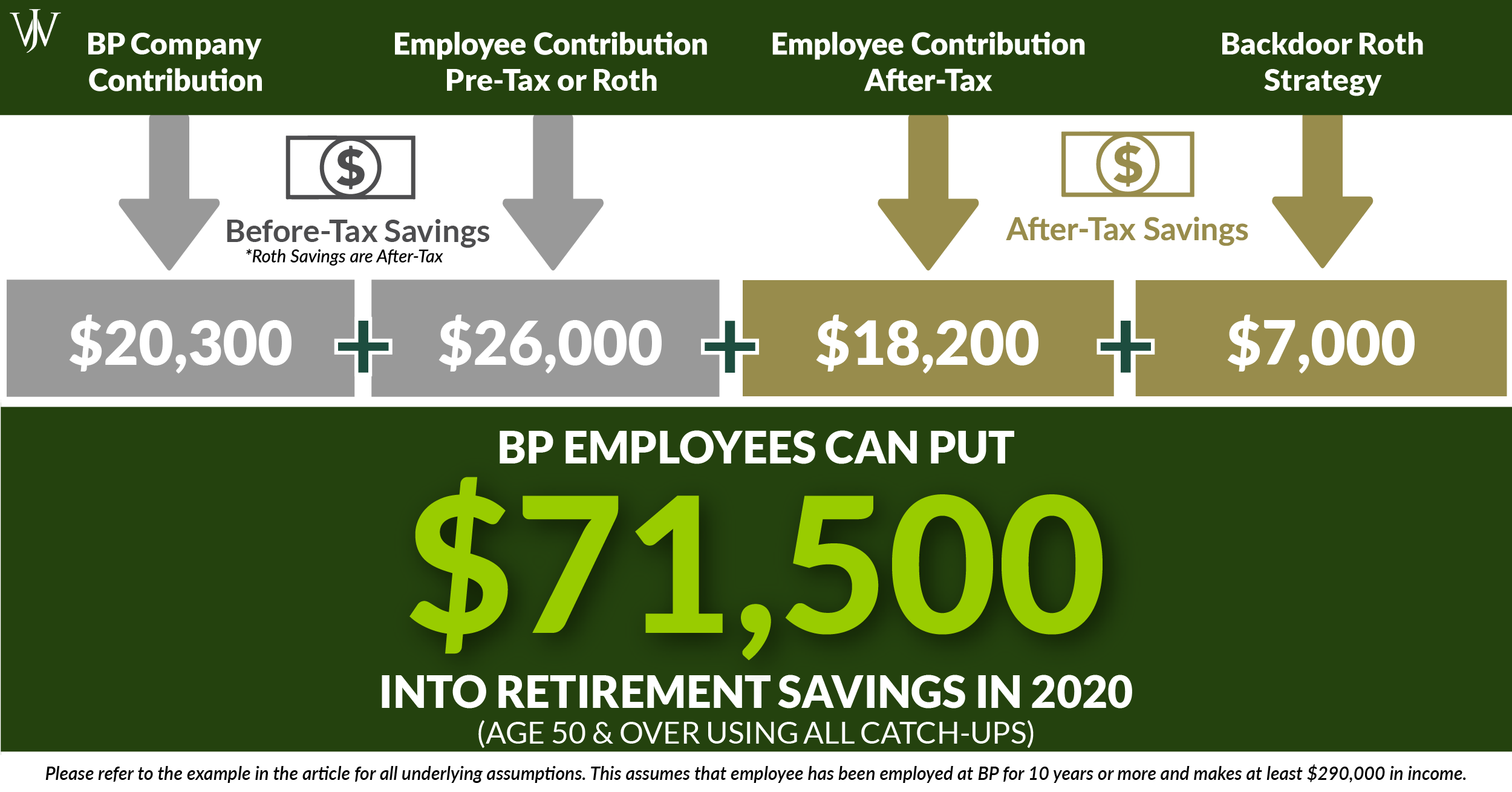

The 2021 combined annual contribution limit for roth and traditional iras is 6 000 7 000 if you re age 50 or older unchanged from 2020. Married filing jointly or qualifying widow er 198 000. Here are the traditional ira phase out ranges for 2021.

Up to the limit 196 000 but 206 000. In 2020 and 2021 the roth ira contribution limits for most people are 6 000 or 7 000 if you re 50 or older. 105 000 to 125 000 married couples filing jointly.

If your magi is more than. Married filing separately and you lived with your spouse at any time during the year 10 000. The maximum annual contribution to roth ira s is generally 5 000 for savers under the age of 50 and 6 000 for savers over 50.

The income ranges for determining eligibility to make deductible contributions to traditional individual retirement arrangements iras to contribute to roth iras and to claim the saver s credit all increased for 2021. 66 000 to 76 000 single taxpayers covered by a workplace retirement plan. If you are married and filing separately single or filing as a head of household you can contribute to a roth ira in tax year 2021 up to the limit for your age if your modified adjusted gross income magi is less than 125 000.

Then you can contribute. 6 000 for those under the age of 50 and 7 000 for those over the age of 50. Similarly ira contribution limits are the same at 6 000 in 2021 and 7 000 for workers over age 50.