2021 Max Simple Ira Contribution Limits

The simple catch up limit is still 3 000.

2021 max simple ira contribution limits. Roth ira contribution limits are reduced or eliminated at. Simple catch up 3 000. Not much has changed for next year.

Ira catch up contribution 1 000. Traditional and roth ira contribution limit. The contribution limit for simple retirement accounts is unchanged at 13 500 for 2021.

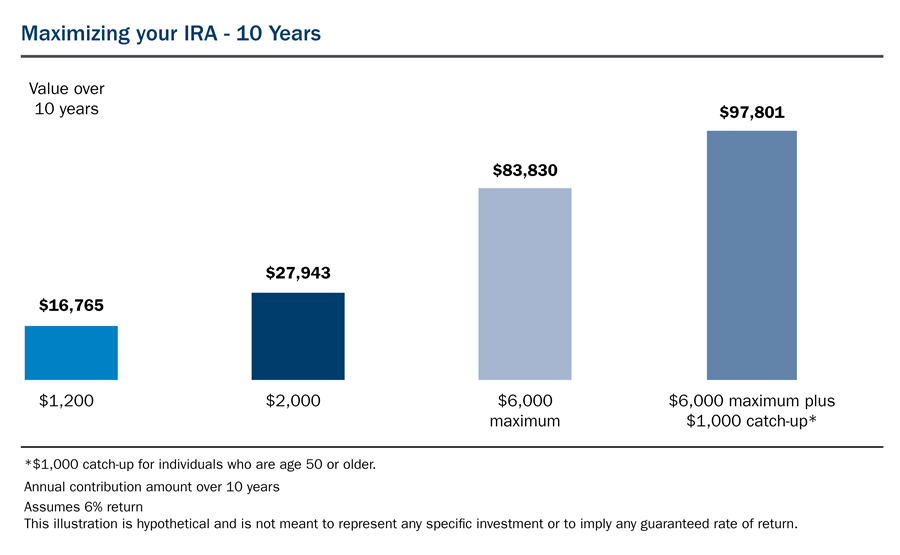

The contribution limit for simple 401k and simple ira plans will stay the same at 13 500 in 2021 as in 2020. For anyone saving for retirement with a traditional or roth ira the 2021 limit on annual contributions to their ira account remains unchanged at 6 000. Ira catch up contribution 1 000.

The amount an employee contributes from their salary to a simple ira cannot exceed 13 500 in 2020 and 2021 13 000 in 2019 and 12 500 in 2015 2018. Employer contributions aren t included in these limits. Employees who are participants in employer sponsored simple ira plans can contribute 13 500 for 2021.

If you re under 50 you can put in up to 6 000 in 2021. 2021 ira contribution limits. Simple ira 13 500.

Ira limit 6 000. The 2021 combined annual contribution limit for roth and traditional iras is 6 000 7 000 if you re age 50 or older unchanged from 2020. Additionally any eligible employee that will attain the age of 50 by december 31 2021 can defer an additional 3 000 for a total of 16 500.