2021 Marginal Tax Brackets

2021 federal income tax brackets and rates in 2021 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows tables 1.

2021 marginal tax brackets. These rates are in effect for 2021 and. The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. 35 for incomes over 209 425 418 850 for married couples filing jointly.

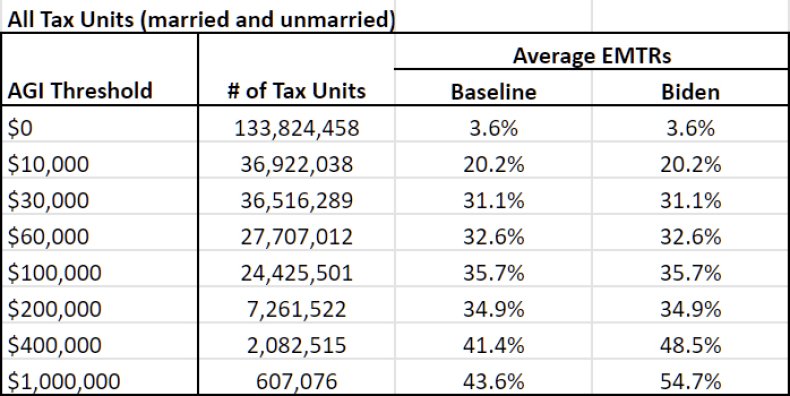

Tax rates current marginal tax rates canada federal personal income tax brackets and tax rates canada federal 2021 and 2020 tax brackets and marginal tax rates income tax act s. Tax rates marginal personal income tax rates for 2021 and 2020 2021 2020 tax brackets and tax rates canada and provinces territories choose your province or territory below to see the combined federal provincial territorial marginal tax. 51 667 plus 45 cents for each 1 over 180 000.

29 467 plus 37 cents for each 1 over 120 000. These brackets are marginal which means that different portions of your income up to a specified dollar amount will be taxed at a different rate. Irs 10 0 to 9 875 0 to 14 100.

The standard deduction for 2021. The above rates do not include the medicare levy of 2. 19 cents for each 1 over 18 200.

Tax rates 2020 2021 year residents the 2021 financial year starts on 1 july 2020 and ends on 30 june 2021. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income of 523 600 and higher for single filers and 628 300 and higher for married couples filing jointly. This month the irs released updates to the tax code for tax year 2021.

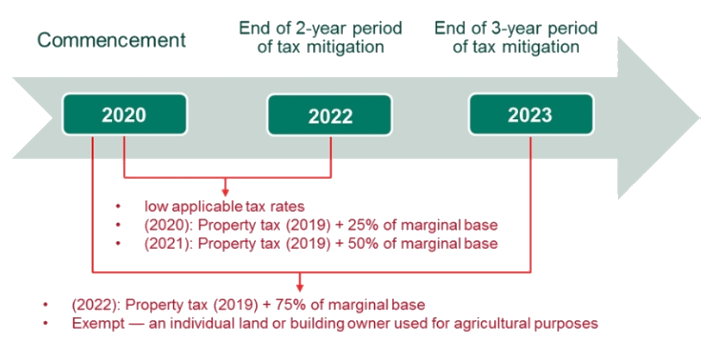

Though actual tax brackets remained the same 10 12 22 24 32 and 35 income limits for each bracket were increased to account for inflation. 117 117 1 121 please read the article. The 2018 budget announced a number of adjustments to the personal tax rates taking effect in the tax years from 1 july 2018 through to 1 july 2024.