2021 Ira Contribution Limits Married

The ira contribution limit is 6 000.

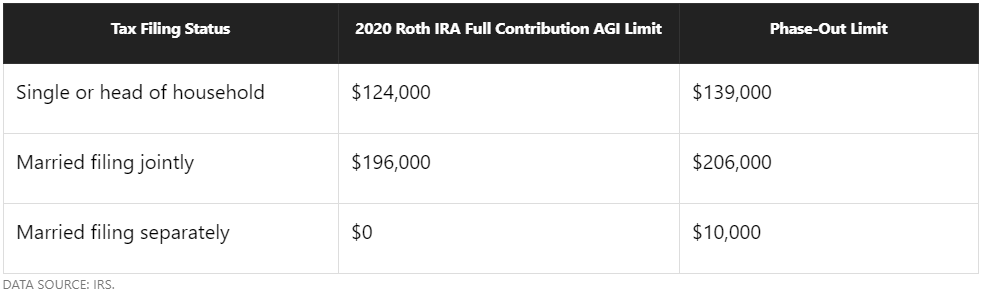

2021 ira contribution limits married. 66 000 to 76 000 single taxpayers covered by a workplace retirement plan. 2021 ira contribution limits. 76 000 for single filers and heads of household up from 75 000 in 2020.

105 000 to 125 000 married couples filing jointly. This applies when the spouse making the ira contribution is covered by a workplace retirement plan. 125 000 for married couples filing jointly up from 124 000 in 2020.

And of course you can likely do a backdoor roth ira if you re over these income limits anyway. Finally the 2021 income limit for the saver s credit for low and moderate income workers is 66 000 for married couples filing jointly 65 000 in 2020 49 500 for head of household filers. The ira catch up contribution limit for 2021 workers age 50 and older can make an extra 1 000 catch up contribution to an ira in 2021 for a maximum possible ira contribution of 7 000 in 2021.

Household taxable income must be equal to or higher than the total contribution amount. 6 000 if you re younger than age 50. Here are the traditional ira phase out ranges for 2021.

Similarly ira contribution limits are the same at 6 000 in 2021 and 7 000 for workers over age 50. Here are the ira limits for 2021. 7 000 if you re aged 50 or older.

10 000 for married. Workers can contribute the same 19 500 to workplace retirement plans in 2021 including 401 k s. The married filing jointly income limit has an equally shocking adjustment from 196 000 to 198 000.